The Uber tax summary is really valuable for tax filing, especially for Uber drivers. As Canada is having the tax season for the taxations of 2021, so every individual is concerned to know about his concerning amount of taxation. Hence, in this regard, we come to know that a tax summary is given by Uber to provide an analysis in the form of a tax document

Rumors regarding tax summary 2021

There are many assumptions regarding Uber tax summary 2021, some individuals regard it to be present, some just focus upon the absence of this summary. But, this article, will provide you with valuable insights to see the new implementations as well as the Uber tax summary for 2021.

What is an Uber tax summary?

The Uber tax summary is actually a kind of documentation that is especially given by Uber. This summary helps to analyze the expenses in the form of annual, monthly as well as business-based.

Moreover, it helps to analyze the deductions that can be there. So, it makes it easy for tax filing.

Important elements of Uber tax summary 2021

|

Sr.no |

Elements |

|

1 |

Uber gross fares |

|

2 |

Booking fee |

|

3 |

Reg, recovery fee |

|

4 |

Airport fee |

|

5 |

Tips |

|

6 |

Split fare |

|

7 |

GST/HST |

-

Uber gross fares

When we go for this terminology, we come to know that it follows individually for Uber Rides and Uber Eats. Hence, for that obvious reason, we will discuss them one by one.

Gross fare for Uber rides

It has two basic elements namely: Time and Distance. Therefore, the gross fare for Uber equalizes the time and distance travelled along with the service fee.

-

- Description

Such kind of fare is charged to passengers by Uber but on the Driver’s behalf!

-

- Method of Calculation

The methodology is really simple. So, it involves the distance travelled and time spent on the trip. Here, the service fee is also charged.

Gross fare for Uber eats

-

- Elements

Pickup fee, drop off fee, distance travelled, service fee

-

- Description

It exists for the drivers who have to perform their duties of food deliveries. This kind of fare is charged to customers by Uber but here too on Driver’s behalf.

-

Booking fee

Another element that is worth considering in the Uber tax summary for 2021 is the Booking fee. So, this fee is charged to riders on your behalf and the rider pays it to you. It is to be noted here that, Uber charges it from you and that in equal amounts. It follows the following credentials

-

- When a request is issued by a rider to book a ride then Uber will find this ride and an order will be booked

- The order should be accepted by the driver

- A driver is charged a fixed amount by Uber when the driver accepts a specific request

- This amount is compensated by the driver as he charges it from the passenger. But, most importantly Uber takes it back!

- This specific amount is then subtracted from the fare

-

Reg. Recovery fee

This fee is present in the form of a license, permit, or any other fee, that is mandatory to pay. So, Uber charges it from drivers on behalf of the trips that a driver do so.

-

Airport fee

As, the name predicts this fee is charged to riders on your behalf, especially for the trips to Airport.

Uber and its agreement with Greater Toronto Airport

On behalf of airport fees, Uber has an agreement with Greater Toronto Airport Authority, also called to be as GTAA.

Basic points of the agreement

-

- This agreement allows the Uber drivers to drop off and pick up the passengers at Pearson Airport

- On account of this act, Uber charges the airport fee from the passengers, which is then charged back by Uber from drivers

- It is to be considered that this fee is included in the fare

- Tips

These are especially paid to the Uber drivers by the riders on the basis of better service

The thing that matters here, is the number of tips given to the drivers by the passengers. So, the tips are collected by Uber, added to the fair and then they are provided to the drivers.

-

Split fare

As the name shows, when the passengers split up their fares using the Uber app then a fee is imposed on passengers on your behalf.

This facility of splitting the fare is being granted by Uber to its passengers. More specifically, we come to know that, this amount is common on Uber XL drivers in the form of tax summaries.

-

GST/HST

The parameter of GST/HST is an essential thing to consider, as it is implemented in the form of sudden fares. Well, it follows in the form of credentials as below.

-

- Whether you follow one trip or more, GST/HST is going to be implemented. Being a Uber driver in Alberta or Ontario GST/HST is deposited in your bank account every week.

- A proper track of these amounts is essential to keep, as these are to be remitted in the form of a minute amount to a Canadian revenue agency

- The remittance methodology occurs in the form of a monthly, quarterly, or annual basis.

What is the new thing for Uber tax summary 2021?

The credentials are the same in the form of different parameters. But it is worth noticing here that we will be observing some new implementations like the monthly analysis of taxes instead of the annual system.

How does it process?

Following the tax summary for 2021, an important process shows that for now, the Uber drivers have to provide the tax analysis on monthly based documentation individually for every month.

Back in 2020, it was present in the form of yearly documentation. So, now this thing occurs on a monthly basis as something new, that must be considered.

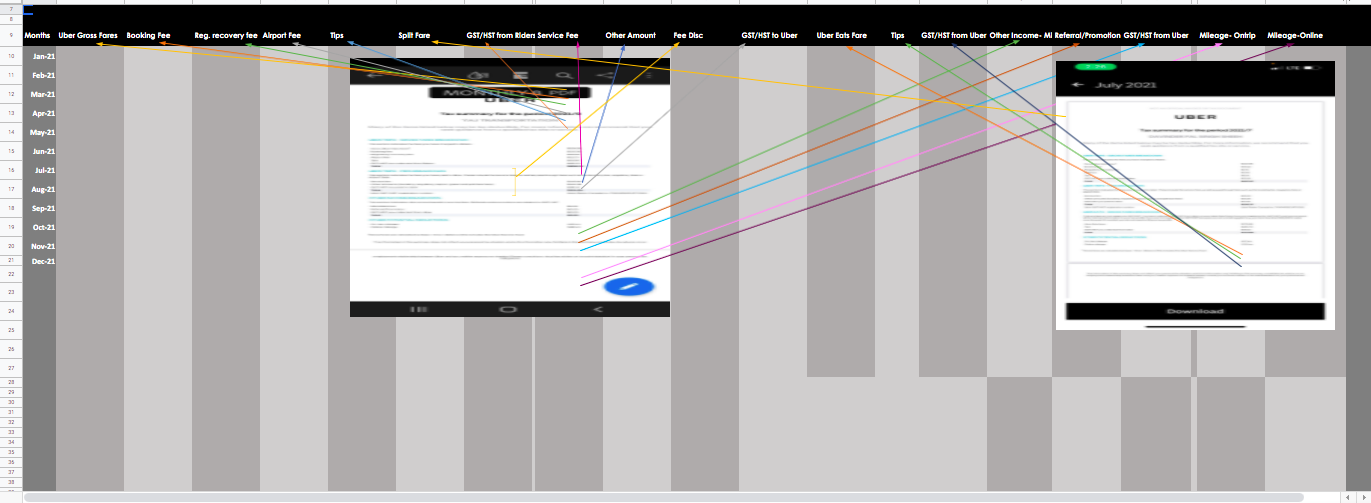

To, make it easy for you Instaccountant has provided an excel sheet that will help greatly. It follows individually both for Uber and Lyft. So, the basic features consist of the following.

Uber Entry

| Sr. no | Contents |

| 1. | Months |

| 2. | Uber gross fares |

| 3. | Booking Fee |

| 4. | Reg. Recovery fee |

| 5. | Airport fee |

| 6. | Tips |

| 7. | Split fare |

| 8. | HST/GST from riders |

| 9. | Service fee |

| 10. | Other amounts |

| 11. | Fee Disc |

| 12. | GST/HST to Uber |

| 13. | Uber Eats Fare |

| 14. | Tips |

| 15. | GST/HST from Uber |

| 16. | Other income- MISC |

| 17. | Referral/Promotion |

| 18. | GST/HST from Uber |

| 19. | Mileage-Ontrip |

| 20. | Mileage-Online |

Important terminologies

HST= Harmonized Sales tax

GST= Goods and Services tax

Mileage= Distance covered

Other terminologies= They have been discussed before

Uber Entry Final Sheet

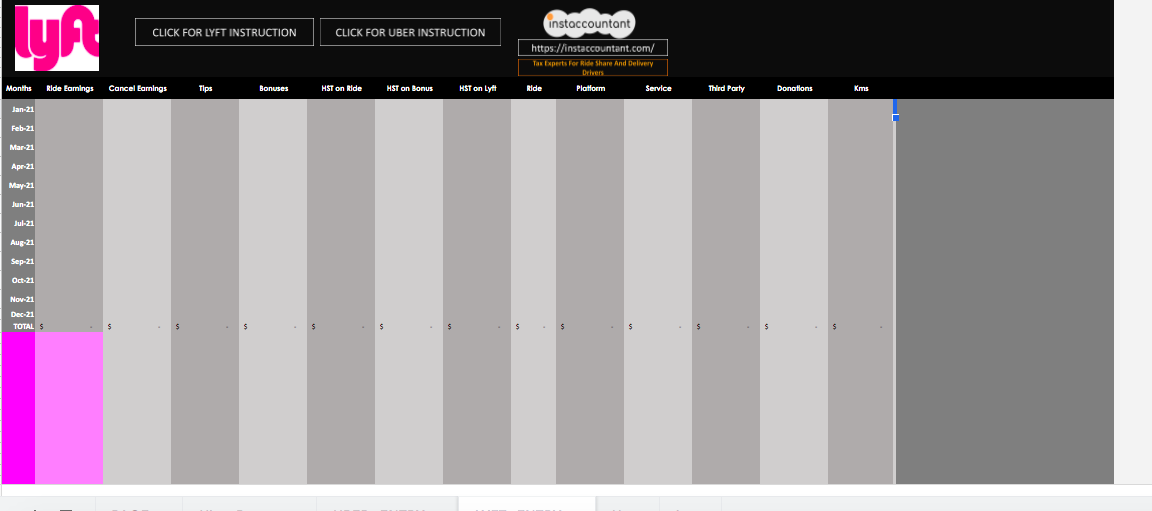

Lyft Entry

| Sr. no | Contents |

| 1. | Months |

| 2. | Ride Earnings |

| 3. | Cancel Earnings |

| 4. | Tips |

| 5. | Bonuses |

| 6. | HST on Ride |

| 7. | HST on Bonus |

| 8. | HST on Lyft |

| 9. | Ride |

| 10. | Platform |

| 11. | Service |

| 12. | Third-party |

| 13. | Donations |

| 14. | Kms |

Important terminologies

Kms= Distance in kilometres

Third-party= Any other external group being involved

Lyft Entry Final sheet

Well! you do not need to be worried to find the link to this sheet, as it has been provided here as below.

If you need further information. Please call at 647-243-2884

Frequently asked questions

What are the criteria to file Uber earnings?

The methodology of this parameter is really simple. All that it takes is the usage of form namely 1040. Furthermore, along with the form, an individual must have the attachment of Schedule C and SE in his documentation of tax filing.

Is tax refund there for Uber drivers?

Like any citizen of Canada, Uber drivers are also entitled to have tax returns as well tax refunds. But all that it takes is the presence of on-time tax filing. As Canada has some additional perks for punctual tax filers, this thing works in a really significant manner.

How do I enter Uber to turbo tax?

This is really simple as an individual should be dependent upon the creation of an official account of TurboTax. After this, one has to select the category and so he will be selecting Uber as his concerned preference. Moreover, it makes sure to have a successful registration at the TurboTax forum.