A lot of our team members, including the founder have worked as incorporated contractors (consultants) for small to large sized organizations in the field of accounting, tax, and management consulting. This exposure makes us better understand the problems faced and the expectations you would have from your accountant as a self-employed.

We are a one-stop accountants for self-employed professionals. We a successfully serving hundreds of professionals and contractors with the following services:

We have developed an app specially for the self-employed professionals. As accountants, and being able to serve hundreds of independent contractors, incorporated contractors and self-employed, we were able to understand the user problems while using bookkeeping and expense tracking apps. We decided to develop our own solution that is 100% “built by accountants for self-employed”. Zoombooks helps self-employed with:

IT consultant, contractor or a professional is someone who provides services which are related to computing, information systems and information technology. Information technology (IT) is a very wide term now. From design to writing a code, implementing and configuring systems, database and analytics, hardware engineering and connectivity to security and support – all of these and more are categorized under information technology. People performing such jobs are termed as IT professionals.

Here are few examples of IT professionals:

This is one of the most frequently asked question in an IT professional’s mind.

We hear this a lot; can I claim expenses related to travel, clothing, car lease, gas, and the list goes on… Confusion? I checked out a blog or a youtube video, and ended up being more confused… Your confusion is understandable. How and why would you know if a certain expense can be claimed as a deduction on your tax returns? You are a programmer (or any other self-employed professional) not a bookkeeper.

Each profession attracts different tax-related opportunities and risks. Expense deductions for tax purposes can be tricky and need to be viewed according to the professional’s circumstances. We encourage our clients to report all the expenses and let the bookkeeper decide if the expense is a business deduction or not. This becomes super easy if you are using Zoombooks.app, it is developed around this idea.

You may have to travel for your work. In general travel could be 20% to 80% of a consultant’s time. For instance, ERP consultants have to travel a lot to their clients. Frequent business traveling in itself is not too much fun, keeping track and detail of your travel spending is definitely a challenge. As a business traveler you will know these problems.

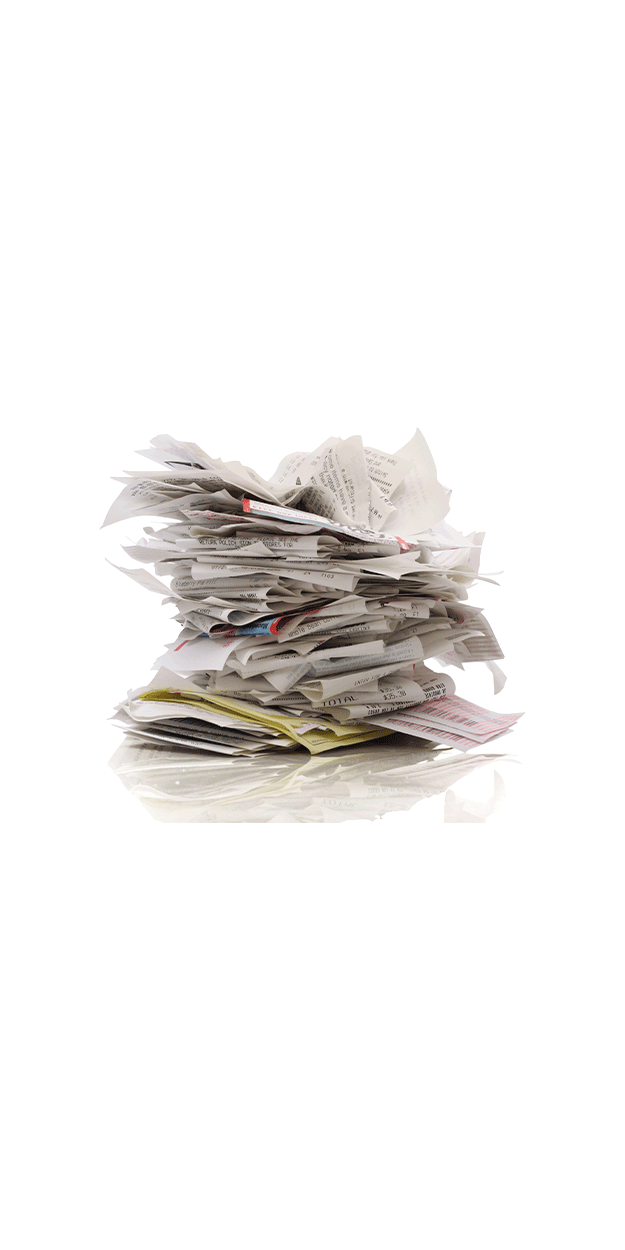

“I paid for this expense but don’t have the receipt”. This happens to you as well. Losing a receipt means you have lost the right to claim a legit expense deductions on your tax return. The result will be paying more taxes. You are risking a CRA tax audit as well.

You are required by Canada Revenue Agency (CRA) to keep source document or receipt for your expenses for 6 years.

In case CRA opens an audit, the auditor does not accept bank statement or credit card statement as a valid proof of expense. They require the actual receipts for audit.

Again, for this we recommend using Zoombooks expense tracker app. You will take photo of the receipt. Zoombooks will scan the receipts, categorize the expenses, save it digitally and provide useful financial and budgeting reports.

I know doing your own bookkeeping is not a easy. Even recording your financials (transactions) in a simple spreadsheet is not fun. Some contractors use different apps for this purpose, which work well if you have good concepts of accounting and bookkeeping. Otherwise its garbage in, garbage out.

Instaccountant provides full service bookkeeping services to IT contractors and IT consultants all around Ontario. We will assess your transaction volume and provide a solution that suits your requirements. For a transaction heavy business, we will set you up on to SaaS solutions like Quickbooks online or Wave. If you have simpler bookkeeping needs, then we recommend using Zoombooks expense tracking app, for saving receipts, expense categorization and reports and anlytics for personal finance.

In general IT consultants/contractors are weak in organizing financial information and sending invoices to customers. You are a consultant who knows how to get his job done. You don’t have to learn invoice formats, clients’ vendor portals, and receivable handling. The problem is that the client’s accounts/finance department looks at you as just another vendor/supplier of services. You have to match their expectations.

We provide full billing and invoicing services to small businesses. We will take care of complete customer invoicing and the accounts receivable and payment lifecycle.

Sometimes you have to bill clients in parts to reach the total project amount. Recording the work done, billing out to clients, and keeping the invoice and payment transactions straightened out is a hassle. In long-term projects, this doesn’t take too much effort to become a nightmare. We understand how progress billing works and help clients be on top of their billing lifecycle.

Our bookkeeper will calculate and keep track of the time sheets, work done and milestone completion. The clients/ customer ledgers will be kept up to date and reconciled with payments and adjustments.

Invoicing clients according to their requirements. For example, you might be asked to signup to client’s portal and create or upload invoices in specified formats. If you have multiple customers and have to go through each customer’s vendor management system for billing. I can bet you are spending a lot of time fulfilling their petty requirements. I know that’s not fair on IT professionals, but that’s the reality, you gotta do what you gotta do to get paid.

Our bookkeepers are quite tech savvy. They will learn how each customer needs to be billed. They make sure timely customer billing is done without creating any fuss at the customer or our own end.

If you work with multiple customers, becoming a victim of late invoicing is very probable. Once you are behind on billing multiple issue arise:

This is an evergreen question. Blogs, vlogs and social media content is filled with information that should answer this question but that doesn’t happen. Because one size doesn’t fit all. There are many factors that contribute to a contractor’s tax and financial situation. All those factors need to be taken into account to decide if a contractor should work self-employed or have a corporation.

Another common question an incorporated contractor, consultant or professional has is if I should get a salary or dividend from my own company? The answer is not as simple as the question itself. This is a very important factor that defines your financial success as a contractor. After all a contractor is taking a risk of not being an employee. He is letting go of the security that comes with employment. Now the salary or dividend or both depend on a lot of factors that have to be analyzed for each contractor individually.

As like other professions, IT contractors, IT consultants and IT self-employed professionals face issues that relate to taxes and financials. I will talk about some common issues here.

We have seen many IT related services clients grow into a full business with many customers and employees. As you grow your accounting and tax services requirements grow too.

It is not always true that getting incorporated saves a contractor taxes. IT contractors and consultants need to have good knowledge and professional grip on their income tax and HST matters. No one would like to see surprises at the end of a year – the time when you say, its time to switch the accountant.

A lot of IT contractors and consultants provide services to overseas clients, specially the USA. This provides a great window of opportunity but at the same time calls for understanding of tax treaties and professional handling of taxes. Similarly, the IT free lancers need to acknowledge the importance of inter-country income and service delivery issues.

Mishandling of financials and taxes may end up in CRA tax or HST audits. We are here to avoid that in first place and help if you are having one.

* Please note, these fees are not final. Fees will be finalized after our detail call.