In this post we are going to answer another question, a lot of Uber drivers ask or are confused about. How Uber Calculates Trip Earnings for Drivers in Toronto, Canada?

In this post we are going to answer another question, a lot of Uber drivers ask or are confused about. How Uber Calculates Trip Earnings for Drivers in Toronto, Canada?

I am going to keep it brief and to the point. You are going to see some simple math along with some underlying logic.

Keep in mind that Uber charges money to riders (passengers) on behalf of the driver. As if the driver directly charges the rider, using Uber as a service to charge rider’s credit card. So Uber will take the money from riders credit card and send to the driver’s account after deducting its own fees (and charges). So that’s the background.

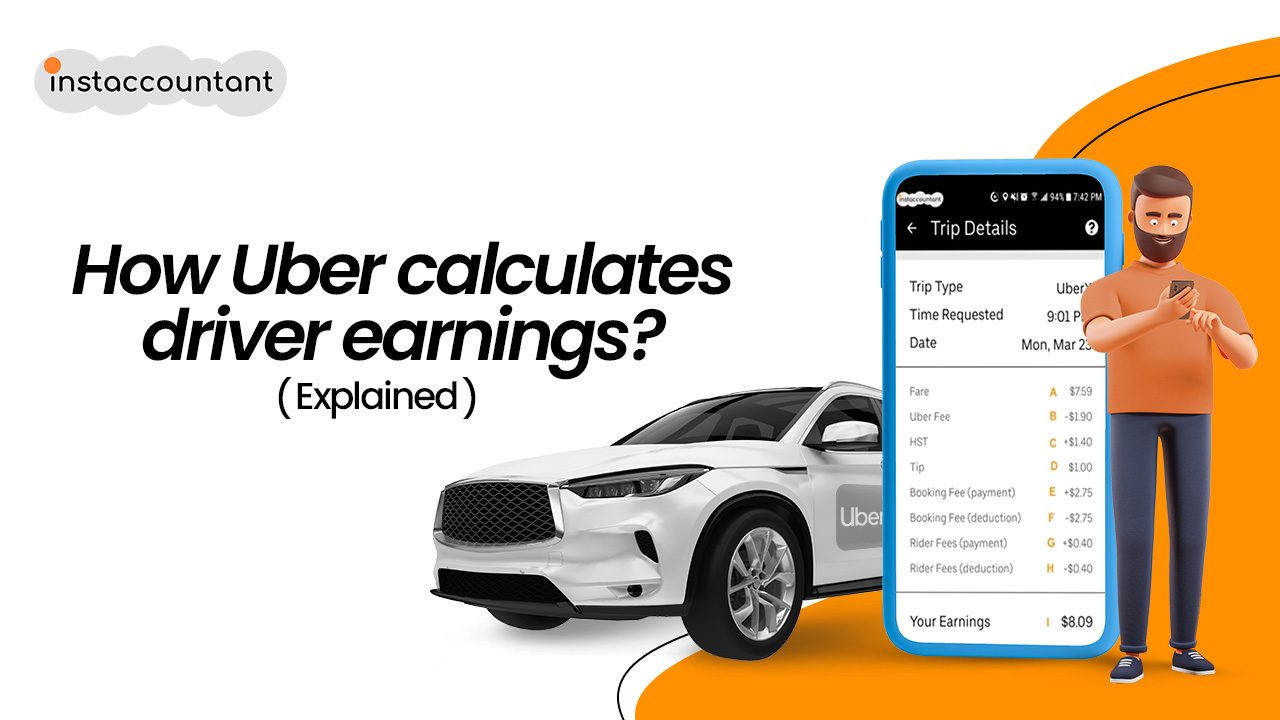

Let’s have a look at a ‘Trip Earning’ of an Uber X ride completed by a driver in Toronto, Ontario Canada. I have labelled the amounts present in the calculation for ease of understanding.

So, for this trip the Uber driver made $8.09 (I) for a ride from point A (pick up point) to point B (destination). He also gets a tip, good job! 😊

We will discuss each (labelled) amount and calculation that makes up trip earning of the Uber driver.

A. Fare

This is the amount charged to the rider (based on distance and time)

B. Uber Fee

25% that Uber takes as its cut or fee calculated on the amount of Fare (A).

How this is calculated:

(B / A) x 100

(1.90 / 7.59) x 100 = 25%

C. HST

The amount of HST charged to rider.

How this is calculated:

(A + E + G) x 13% = C

(7.59 + 2.75 + 0.40) x 13% = 1.40

D. Tip

The amount of tip received from rider (added to earning).

E and F. Booking Fee

A fixed booking fee received from rider by Uber on driver’s behalf.

This amount is added to the earning (E).

Same amount is deducted from earning (F) by Uber.

It’s net effect on earning is zero. This is one of Uber’s charges and fees (for details, you can read about it here).

G and H. Rider Fee

A fixed fees received from rider by Uber on driver’s behalf.

This amount is added to the earning (G).

Same amount is deducted from earning (H) by Uber.

Just like booking fee (above), it’s net effect on earning is zero. This is one of Uber’s charges and fees (for details, you can read about it here).

I. Your Earnings

This is the final amount that is paid to the driver by Uber. This amount is transferred to the driver’s bank account.

How this is calculated:

(A – B + C + D) = I

(7.59 – 1.90 + 1.40 + 1.00) = 8.09

One more thing to keep in mind, HST is NOT your income! Uber makes it look like its your income, its not. Technically, HST collected is a liability. You have to remit the Net HST (collected vs paid) amount to CRA (Canada Revenue Agency) at the end of the year (or a specific period).

If you have any questions regarding Uber/ Lyft or self-employed tax filing. Please call at: 647 243 2884

The Author of this post is a professional accountant specializing in filing taxes for Uber drivers, self-employed, and incorporated contractors.

Income Tax and HST/GST for Uber and Lyft Drivers

Disclaimer: This is a general explanation and should be used only for informative and understanding purpose. This article cannot be used or referenced for legal or tax purposes. Every tax situation is different. You should consult a lawyer or accountant to understand application in a particular tax situation.

One Response