If you are a Real Estate Agent in Canada, you don’t just sell properties, you are running a small business. Whether you are closing deals in the Toronto GTA, Vancouver or Halifax, the CRA views you as a self-employed commission salesperson.

One of the biggest mistakes I see Realtors make is treating their real estate career like a paycheck rather than a business. If you are self-employed, the CRA expects you to run like one. That means bookkeeping, keeping receipts and knowing exactly what you can write off.

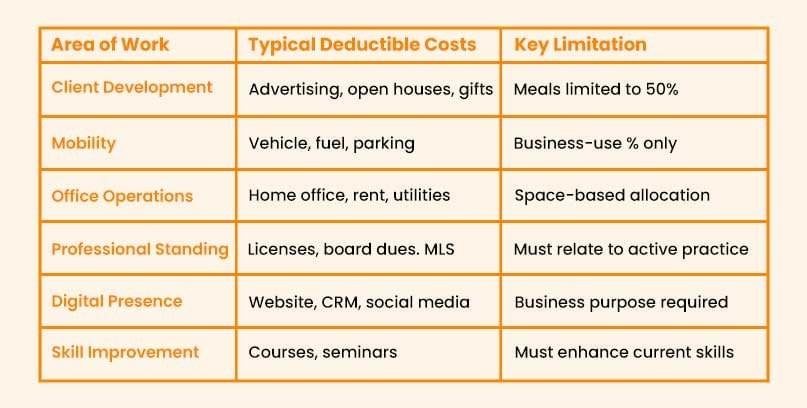

Let’s cut through the jargon. Here is your practical, CPA-approved guide to real estate agent tax deductions so you can keep more of those hard-earned commissions.

1. Vehicle Expenses

This is almost always the largest deduction for real estate agents. But it’s also the biggest red flag for the CRA if you don’t do it right.

The Golden Rule: You cannot deduct 100% of your car costs. You must separate business use from personal use.

To do this, you need a mileage log. It sounds tedious, but it is your only defense in an audit. You need to track:

- Total KM driven in the year.

- Business KM driven (showings, open houses, listing presentations, broker meetings).

Once you have your percentage (e.g., 80% business), you can deduct that portion of:

- Gas and oil

- Insurance and registration

- Maintenance and repairs (tires, oil changes)

- Lease payments (interest if financed)

- Parking and tolls (These are usually 100% deductible if purely for business)

If you use an app like MileIQ or Zoombooks, the tracking is automatic. The CRA prefers a digital log over a scribbled notebook.

2. Home Office Deductions

Many real estate agents, especially part-timers, run their business from a home office. If you do, you are entitled to claim a portion of your housing costs.

How to calculate it: Measure the square footage of the space used exclusively for work (your office) and divide it by the total square footage of your house. That percentage is applied to:

- Heat and Electricity

- Water

- Home Insurance

- Mortgage Interest (not the principal payment)

- Internet (crucial for virtual tours and emails)

Warning: Be careful not to overclaim. If your office is 50% of your house, the CRA will raise eyebrows. Stick to a reasonable workspace percentage (usually 10-20%).

The temporary flat rate method for home office expenses (introduced during COVID to simplify claims) is no longer available. Starting with the 2023 tax year and continuing into 2026, the CRA requires you to use the detailed method.

3. Marketing and Advertising

In real estate, you are the product. Almost anything you do to generate leads or build your brand is a legitimate business expense.

Digital & Online Expenses:

- Website: Domain hosting, maintenance, and professional design.

- Listing Ads: Google Ads (AdWords), Facebook/Instagram sponsored posts.

- Virtual Tours: Costs for 3D tours, drone photography, and professional listing photos.

- Zillow/Realtor.ca Fees: Fees paid to boost your listings on MLS or premium portals.

Physical Marketing:

- “Just Sold” & “For Sale” Signs: Lawn signs and directional signs.

- Print Materials: Business cards, feature sheets, and brochures.

- Open House Supplies: Flowers, snacks, or coffee (see Meals section below).

Lead Generation: If you pay a service for real estate leads, this is a standard business expense.

4. Meals, Entertainment and Hospitality

Realtors spend a lot of time building relationships over coffee or lunch. The CRA allows this, but it is strictly regulated.

The Rule: You can deduct 50% of the cost of meals and entertainment incurred for business purposes.

What is Allowed:

- Coffee or lunch with a first-time home buyer to discuss their criteria.

- Dinner with a potential seller to pitch your listing strategy.

- Networking events where you are generating leads.

What is NOT Allowed:

- Eating alone while driving (this is a personal expense).

- A team party that isn’t open to clients (often taxable benefits).

Documentation: Keep the receipt and write WHO you were with and WHY it was business related on the receipt. If you don’t have the name, the CRA can deny it.

Client Gifts: You can deduct gifts to clients, but usually only up to $500 per person per year.

- Example: A closing gift basket is deductible.

- Caution: Do not mix gifts with meals. If you take a client to lunch, it’s meals. If you mail them a gift card, it’s a gift.

5. Commissions, Fees, and Dues

This is the cost of doing business. You can deduct the fees you pay to stay active and licensed.

- Board Dues: Membership fees for CREA, OREA, TREB, and your local real estate board.

- Desk Fees: Monthly fees paid to your brokerage for desk space or office use.

- Commission Splits: The money you pay your brokerage is your cost of goods sold.

- Legal Fees: Fees paid to a lawyer to review purchase agreements or close deals.

- Accounting Fees: The fee you pay to have your T2125 Form professionally prepared.

6. Technology and Software

You live in your CRM and your phone. Write it off.

- Hardware: Laptops, tablets, smartphones, printers, and cameras. (Note: Items over $500 usually need to be depreciated over time, rather than expensed all at once).

- Software: CRM subscriptions (Top Producer, KVCore, LionDesk), document signing software (DocuSign), email marketing tools (Mailchimp), and cloud storage.

- Communication: Your cell phone bill (business portion only) and long-distance charges.

7. Education and Professional Development

The real estate market shifts. To write off education, it must be taken to maintain or upgrade your skills.

- Allowable: Courses to get your Real Estate License (or renew it), courses on negotiation, or certifications (e.g., Seniors Real Estate Specialist).

- Not Allowable: Courses taken to get a job in a completely different career.

- Business Seminars: Tickets to real estate investing conferences are deductible, including travel and accommodation.

Expert Note: You cannot usually claim the cost of your initial licensing education to become an agent (tuition credit might apply here), but you can claim courses taken to improve your skills once you are licensed.

8. Other Common Deductions

Don’t forget the smaller things that add up:

- Office Supplies: Paper, ink, pens, stationery.

- Bank Charges: Business bank account monthly fees.

- Legal & Accounting: Fees paid to your accountant to prepare your Form T2125 or a lawyer to review contracts.

Final Advice

Tax season shouldn’t be a panic attack. The CRA allows you to deduct expenses that are “reasonable” and incurred for the purpose of earning income. The key is documentation.

If you treat your real estate practice like a serious business, the CRA will too. Keep your receipts, log your miles and don’t be afraid to claim what you are legally entitled to.

FAQs

- Can I deduct my work clothes? Generally, no. You cannot deduct the cost of “regular” clothing, even if you only wear it for open houses (suits, blazers, dress shoes). The only exception is if the clothing is branded with your logo (a uniform) or is safety gear (e.g., steel-toed boots for a property manager inspecting construction sites).

- I drive a luxury SUV. Can I still deduct it? Yes, but there are limits. If you buy a luxury passenger vehicle (over a certain cost threshold set by the CRA), there is a cap on how much Capital Cost Allowance (CCA) you can claim (usually around $36,000 + HST for the year of acquisition). If you lease, there is a limit on the monthly lease payment you can deduct ($900 + HST per month as of recent guidelines).

- Do I need to register for GST/HST? If your gross revenue (total commissions before expenses) exceeds $30,000 in a single quarter or over four consecutive quarters, you must register for GST/HST. Once registered, you must charge GST/HST on your services and file returns.

If you are a Real Estate Agent in Canada, you don’t just sell properties, you are running a small business. Whether you are closing deals in the Toronto GTA, Vancouver or Halifax, the CRA views you as a self-employed commission salesperson.

One of the biggest mistakes I see Realtors make is treating their real estate career like a paycheck rather than a business. If you are self-employed, the CRA expects you to run like one. That means bookkeeping, keeping receipts and knowing exactly what you can write off.

Let’s cut through the jargon. Here is your practical, CPA-approved guide to real estate agent tax deductions so you can keep more of those hard-earned commissions.

1. Vehicle Expenses

This is almost always the largest deduction for real estate agents. But it’s also the biggest red flag for the CRA if you don’t do it right.

The Golden Rule: You cannot deduct 100% of your car costs. You must separate business use from personal use.

To do this, you need a mileage log. It sounds tedious, but it is your only defense in an audit. You need to track:

- Total KM driven in the year.

- Business KM driven (showings, open houses, listing presentations, broker meetings).

Once you have your percentage (e.g., 80% business), you can deduct that portion of:

- Gas and oil

- Insurance and registration

- Maintenance and repairs (tires, oil changes)

- Lease payments (interest if financed)

- Parking and tolls (These are usually 100% deductible if purely for business)

If you use an app like MileIQ or Zoombooks, the tracking is automatic. The CRA prefers a digital log over a scribbled notebook.

2. Home Office Deductions

Many real estate agents, especially part-timers, run their business from a home office. If you do, you are entitled to claim a portion of your housing costs.

How to calculate it: Measure the square footage of the space used exclusively for work (your office) and divide it by the total square footage of your house. That percentage is applied to:

- Heat and Electricity

- Water

- Home Insurance

- Mortgage Interest (not the principal payment)

- Internet (crucial for virtual tours and emails)

Warning: Be careful not to overclaim. If your office is 50% of your house, the CRA will raise eyebrows. Stick to a reasonable workspace percentage (usually 10-20%).

The temporary flat rate method for home office expenses (introduced during COVID to simplify claims) is no longer available. Starting with the 2023 tax year and continuing into 2026, the CRA requires you to use the detailed method.

3. Marketing and Advertising

In real estate, you are the product. Almost anything you do to generate leads or build your brand is a legitimate business expense.

Digital & Online Expenses:

- Website: Domain hosting, maintenance, and professional design.

- Listing Ads: Google Ads (AdWords), Facebook/Instagram sponsored posts.

- Virtual Tours: Costs for 3D tours, drone photography, and professional listing photos.

- Zillow/Realtor.ca Fees: Fees paid to boost your listings on MLS or premium portals.

Physical Marketing:

- “Just Sold” & “For Sale” Signs: Lawn signs and directional signs.

- Print Materials: Business cards, feature sheets, and brochures.

- Open House Supplies: Flowers, snacks, or coffee (see Meals section below).

Lead Generation: If you pay a service for real estate leads, this is a standard business expense.

4. Meals, Entertainment and Hospitality

Realtors spend a lot of time building relationships over coffee or lunch. The CRA allows this, but it is strictly regulated.

The Rule: You can deduct 50% of the cost of meals and entertainment incurred for business purposes.

What is Allowed:

- Coffee or lunch with a first-time home buyer to discuss their criteria.

- Dinner with a potential seller to pitch your listing strategy.

- Networking events where you are generating leads.

What is NOT Allowed:

- Eating alone while driving (this is a personal expense).

- A team party that isn’t open to clients (often taxable benefits).

Documentation: Keep the receipt and write WHO you were with and WHY it was business related on the receipt. If you don’t have the name, the CRA can deny it.

Client Gifts: You can deduct gifts to clients, but usually only up to $500 per person per year.

- Example: A closing gift basket is deductible.

- Caution: Do not mix gifts with meals. If you take a client to lunch, it’s meals. If you mail them a gift card, it’s a gift.

5. Commissions, Fees, and Dues

This is the cost of doing business. You can deduct the fees you pay to stay active and licensed.

- Board Dues: Membership fees for CREA, OREA, TREB, and your local real estate board.

- Desk Fees: Monthly fees paid to your brokerage for desk space or office use.

- Commission Splits: The money you pay your brokerage is your cost of goods sold.

- Legal Fees: Fees paid to a lawyer to review purchase agreements or close deals.

- Accounting Fees: The fee you pay to have your T2125 Form professionally prepared.

6. Technology and Software

You live in your CRM and your phone. Write it off.

- Hardware: Laptops, tablets, smartphones, printers, and cameras. (Note: Items over $500 usually need to be depreciated over time, rather than expensed all at once).

- Software: CRM subscriptions (Top Producer, KVCore, LionDesk), document signing software (DocuSign), email marketing tools (Mailchimp), and cloud storage.

- Communication: Your cell phone bill (business portion only) and long-distance charges.

7. Education and Professional Development

The real estate market shifts. To write off education, it must be taken to maintain or upgrade your skills.

- Allowable: Courses to get your Real Estate License (or renew it), courses on negotiation, or certifications (e.g., Seniors Real Estate Specialist).

- Not Allowable: Courses taken to get a job in a completely different career.

- Business Seminars: Tickets to real estate investing conferences are deductible, including travel and accommodation.

Expert Note: You cannot usually claim the cost of your initial licensing education to become an agent (tuition credit might apply here), but you can claim courses taken to improve your skills once you are licensed.

8. Other Common Deductions

Don’t forget the smaller things that add up:

- Office Supplies: Paper, ink, pens, stationery.

- Bank Charges: Business bank account monthly fees.

- Legal & Accounting: Fees paid to your accountant to prepare your Form T2125 or a lawyer to review contracts.

Final Advice

Tax season shouldn’t be a panic attack. The CRA allows you to deduct expenses that are “reasonable” and incurred for the purpose of earning income. The key is documentation.

If you treat your real estate practice like a serious business, the CRA will too. Keep your receipts, log your miles and don’t be afraid to claim what you are legally entitled to.

FAQs

- Can I deduct my work clothes? Generally, no. You cannot deduct the cost of “regular” clothing, even if you only wear it for open houses (suits, blazers, dress shoes). The only exception is if the clothing is branded with your logo (a uniform) or is safety gear (e.g., steel-toed boots for a property manager inspecting construction sites).

- I drive a luxury SUV. Can I still deduct it? Yes, but there are limits. If you buy a luxury passenger vehicle (over a certain cost threshold set by the CRA), there is a cap on how much Capital Cost Allowance (CCA) you can claim (usually around $36,000 + HST for the year of acquisition). If you lease, there is a limit on the monthly lease payment you can deduct ($900 + HST per month as of recent guidelines).

- Do I need to register for GST/HST? If your gross revenue (total commissions before expenses) exceeds $30,000 in a single quarter or over four consecutive quarters, you must register for GST/HST. Once registered, you must charge GST/HST on your services and file returns.

2 Responses

What do you mean commission paid to third parties

Paying agents or brokers for sales or services counts as a deductible business expense.