A common point of confusion for new Uber drivers is why the “Gross Fare” on your statement doesn’t match the cash in your pocket. To understand your earnings, you have to look at the “flow-through” logic Uber uses.

How Uber Calculates Your Trip Earnings

To understand your pay, you first need to know how the money moves. Uber acts as the payment processor. When a rider pays, Uber charges their credit card as if they are paying the driver directly. The platform then takes its cut before transferring the remaining balance to the driver’s account.

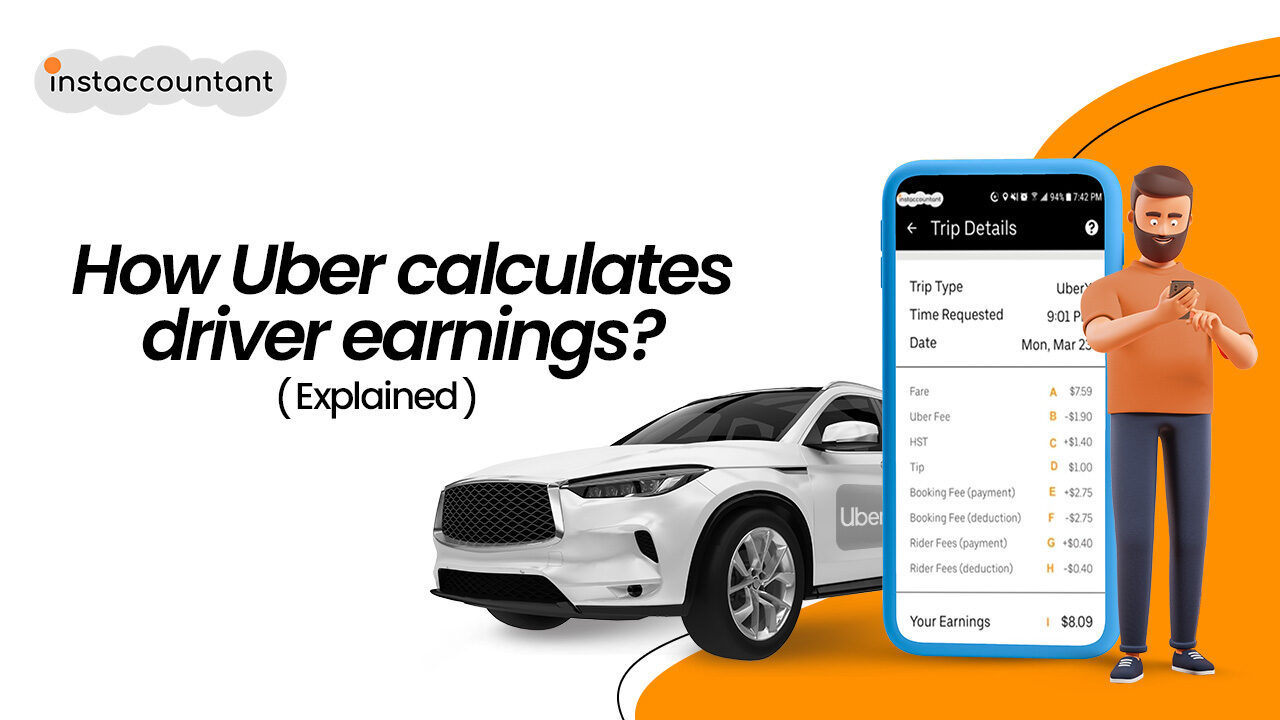

Let’s look at a real-world example of a completed Uber X trip in Toronto. We will use specific labels to make the breakdown easy to follow.

For this specific trip, the driver received a total payout of $8.09 (Label I). Here is exactly how that number was calculated.

What Is Included in an Uber Driver Tax Summary?

An Uber tax summary provides a detailed overview of your driver earnings and deductions for the tax year. It shows how much income you earned through Uber, how that income was calculated, and what amounts were withheld before payouts. This summary is essential for filing taxes as a self-employed Uber driver.

Typically, an Uber tax summary includes:

The Base Fare

This is the starting point. It is the amount charged to the rider based on the distance travelled and the time spent in the car. In our example, this base fare is $7.59.

The Service Fee Deduction

This is the portion Uber keeps. It is calculated as a percentage of the base fare. For this trip, the driver paid a 25% service fee.

Here is the math ($1.90 divided by $7.59) multiplied by 100 equals 25%

While the percentage can vary based on promotions or vehicle types, this fee covers the use of the Uber app and the processing of the payment.

The Booking Fee and Rider Fees

You will often see a booking fee and a rider fee listed on the fare breakdown. These are fixed fees collected from the rider.

- The rider pays these fees on top of the fare.

- Uber collects these fees on the driver’s behalf.

Technically, these amounts appear to be added to the driver’s earnings and then immediately deducted. It looks confusing, but the net effect on your wallet is zero. These are strictly administrative fees passed from the rider to Uber.

HST on the Trip

This line item represents the Harmonized Sales Tax charged to the rider. In Toronto, the rate is 13%.

The calculation looks like this (Base Fare plus Booking Fee plus Rider Fee) multiplied by 13% equals Total HST ($7.59 + $2.75 + $0.40) multiplied by 13% equals $1.40

It is crucial to understand that this tax is collected by Uber but passed through to you as part of the gross payout. You are legally responsible for this money.

Tips and Gratuity

Uber drivers keep 100% of the tips. In our example, the driver received a $1.00 tip. This amount is added directly to your earnings without any Uber commission taken out.

How Your Final Pay Is Calculated

At the end of the ride, you want to know your “Take Home Pay.” This is the final amount deposited into your bank account. The calculation follows this formula

Base Fare minus Service Fee plus HST plus Tip equals Your Earnings ($7.59 – $1.90 + $1.40 + $1.00) equals $8.09

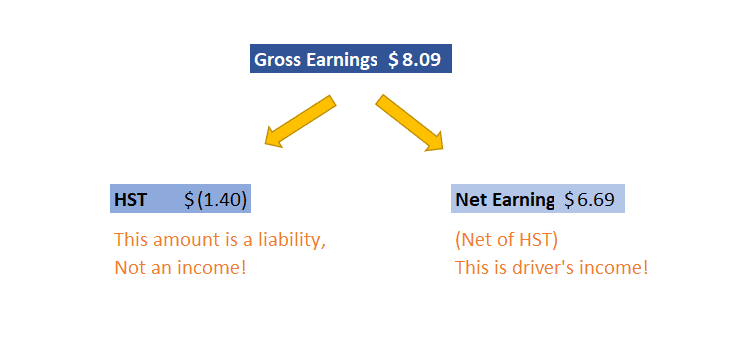

The Truth About HST and CRA Tax Obligations

There is a common misconception among drivers. When you see HST listed in your earnings, it might feel like income. It is not. The HST collected is a liability, meaning you are holding that money in trust for the government.

Uber Collects HST on Your Behalf

When the rider pays, Uber collects the tax. However, because you are the registered operator of the vehicle, you are responsible for remitting the Net HST to the Canada Revenue Agency (CRA).

HST Obligations for Uber Drivers

You must file your HST return with the CRA. You will report the HST you collected from riders (like the $1.40 in our example) and subtract any HST you paid on eligible business expenses like gas, car maintenance, or insurance. The difference is what you owe the government.

If you do not track your expenses, you might end up paying tax on money you should be keeping. This is why using a dedicated expense tracking app is vital for rideshare drivers.

What Expenses Uber Drivers Deduct in Canada

To lower your tax bill legally, you must claim all eligible business expenses. Common deductions for Uber drivers include

- Fuel and maintenance

- Insurance

- Vehicle depreciation

- Car washes

- Cleaning supplies

By keeping accurate records of these expenses, you can reduce the amount of Net HST you owe and lower your overall income tax bill. Always consult with a tax professional to ensure you are compliant with the latest CRA regulations for rideshare drivers.