The Multigenerational Home Renovation Tax Credit (MHRTC) is a game-changer for homeowners, starting with the 2023 tax year. It’s a refundable tax credit designed to promote multigenerational living by facilitating home renovations that create a self-contained secondary unit. This space allows a senior or an adult who qualifies for the disability tax credit to reside with a qualifying relative. The result? More convenience and comfort for extended family living under one roof.

Eligibility for the Multigenerational Home Renovation Tax Credit:

To be eligible for the MHRTC, you must meet the following criteria:

Homeownership: You must own a home in Canada that serves as your principal residence, and you must share the home with at least one other person who is related to you by blood, marriage, common-law partnership, or adoption. The other person must be either a senior (aged 65 or older), a person with a disability, or a dependent child (under 18 years old).

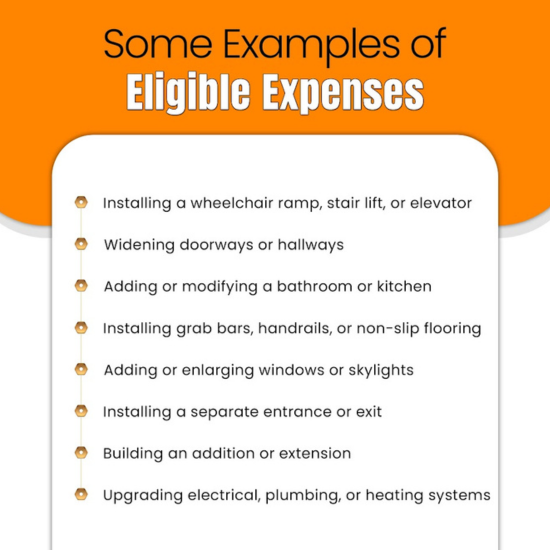

Multigenerational Living: The renovations or retrofits must improve the functionality, accessibility, or safety of the home for multigenerational living. The secondary unit must meet specific criteria and be designated for the eligible family member, a senior, or an adult with a disability.

Completion Date: You need to obtain a certificate from your contractor that confirms the nature and cost of the work done. You can then claim the credit on your income tax return for the year in which the work was completed. Be sure to keep records of your expenses and receipts as supporting documentation.

How to Claim the Multigenerational Home Renovation Tax Credit:

Claiming the Multigenerational Home Renovation Tax Credit is a straightforward process. Here’s what you need to do:

Step 1: Gather Documentation: Collect all relevant receipts, invoices, and contracts related to the qualifying renovation expenses. These documents will serve as proof of your eligible expenditures.

Step 2: Complete Your Income Tax and Benefit Return: When you file your income tax and benefit return, include the MHRTC claim on your 2023 return. To claim the Multigenerational Home Renovation Tax Credit, you need to report it on line 45355 of your T1 income tax and benefit return. This credit can be claimed for the renovation period starting from the taxation year of 2023 or later.

Step 3: Calculate Your Claim: Calculate the total amount of qualifying expenditures you incurred for each completed qualifying renovation. Using Schedule 12, you can easily calculate the credit for your expenses. Remember, you can claim up to $50,000 for each renovation.

Step 4: Determine Your Tax Credit: The MHRTC offers a tax credit of 15% of your costs, up to a maximum of $7,500 for each claim you are eligible to make. Calculate your tax credit based on your qualifying expenditures.

How Much Can You Claim with the MHRTC:

With the Multigenerational Home Renovation Tax Credit, you have the potential to claim up to $50,000 in qualifying expenditures for each completed qualifying renovation. The tax credit is calculated at 15% of your costs, capped at a maximum of $7,500 per claim. It’s important to note that you can claim the MHRTC for one qualifying renovation during the lifetime of a qualifying individual. This individual can be a senior or an adult eligible for the disability tax credit.

Conclusion:

The Multigenerational Home Renovation Tax Credit (MHRTC) in Canada is a fantastic opportunity to save on your home renovations while fostering intergenerational living arrangements. By creating a self-contained secondary unit, you can provide a comfortable and inclusive space for a senior or an adult eligible for the disability tax credit to live with a qualifying relative. Remember to meet the eligibility requirements, keep proper documentation, and claim the credit when filing your tax return. So, whether you’re planning to build an additional suite, expand existing living spaces, or make modifications to create separate living areas, the MHRTC is here to support you. Start exploring your renovation options and take advantage of this exciting opportunity to create a more inclusive and harmonious living environment for your family. Happy renovating!