If you’re self-employed in Canada, you may be wondering how to file your GST/HST returns. GST/HST is a value-added tax that applies to most goods and services sold in Canada. As a self-employed person, you need to know if you have to register for GST/HST, how to calculate and report your GST/HST, and when and how to pay it.

This comprehensive guide will give you a complete guide on filing GST/HST for self-employed in Canada, and answer some of the most common questions you may have. Whether you’re a freelancer, a contractor, or a small business owner, this post will help you understand and comply with the GST/HST rules and avoid any penalties or audits.

1. When to Register for GST/HST in Canada

If you are self-employed in Canada, you may be wondering if you need to register for GST/HST and collect it from your customers. The answer depends on whether you are a “small supplier” or not. A small supplier is a business that makes less than $30,000 in sales within a certain time frame. If you are a small supplier, you don’t have to register for GST/HST, unless you provide taxi or limousine services, or you sell goods or services outside Canada. However, you can still choose to register voluntarily if you want to claim input tax credits (ITCs) for the GST/HST you pay on your business expenses.

If you are not a small supplier, you must register for GST/HST as soon as you exceed the $30,000 threshold. You can register online, by phone, by mail, or in person at a tax services office. Once you register, you will receive a GST/HST business number that you will use to file your returns and remit the tax you collect.

2. Current GST/HST Rates Across Canadian Provinces

The GST/HST rate that you charge to your customers depends on where they are located and what type of goods or services you sell. The GST is a 5% federal tax that applies to most taxable supplies in Canada. The HST is a harmonized tax that combines the GST with the provincial sales tax (PST) in some provinces. The HST rates vary from 13% to 15%, depending on the province.

Here is a table of the current GST/HST rates across Canada as of January 1, 2024:

Note that Quebec and Saskatchewan administer their own provincial sales taxes separately from the GST, so you may need to register and remit both taxes if you do business in those provinces. For more information, contact Revenue Québec or the Saskatchewan Ministry of Finance.

3. Quick Method of GST/HST Remittance

If you are a small business with annual taxable sales of $400,000 or less, you may be eligible to use the quick method of GST/HST remittance. This is a simplified way of calculating and remitting the GST/HST that can save you time and money. Instead of remitting the actual amount of GST/HST that you collect from your customers, you remit a percentage of your sales based on your business category and location. You also get to keep a part of the GST/HST that you pay on your business expenses as an ITC.

To use the quick method, you need to apply online or by mail using Form GST74, Election and Revocation of an Election to Use the Quick Method of Accounting. You can start using the quick method on the first day of your next fiscal quarter after the CRA approves your application.

4. GST/HST Filing Thresholds in Canada

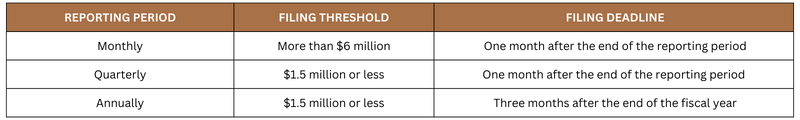

The frequency of filing your GST/HST returns depends on your annual taxable sales and your reporting period. Your reporting period is usually your fiscal year, unless you choose or are required to use a different period. You can file your returns monthly, quarterly, or annually, depending on your filing threshold.

Here are the filing thresholds and deadlines for each reporting period:

Note that some businesses are required to file monthly or quarterly regardless of their sales, such as builders, charities, public service bodies, and selected listed financial institutions. You can also choose to file more frequently than required if you prefer.

You can file your GST/HST returns online using NETFILE, My Business Account, or a third-party software. You can also file by phone using TELEFILE, or by mail using a paper return. Make sure to file your returns on time to avoid penalties and interest.

5. How to Pay Less GST/HST with the Quick Method

One of the benefits of using the quick method of GST/HST remittance is that you can pay less tax than you would with the regular method. This is because the remittance rates for the quick method are lower than the GST/HST rates that you charge to your customers, and you also get to keep a part of the tax that you pay on your business expenses.

For example, let’s say you run a consulting business in Ontario and you have $100,000 in annual taxable sales. If you use the regular method, you would collect $13,000 in HST from your customers and pay $2,600 in HST on your business expenses. Your net tax would be $10,400 ($13,000 – $2,600).

If you use the quick method, you would still collect $13,000 in HST from your customers, but you would remit 8.8% of your sales plus 1% of the first $30,000. Your net tax would be $9,300 ($8,800 + $300). You would also keep 1% of the HST that you pay on your business expenses as an ITC, which is $26 in this case. Your total savings would be $1,126 ($10,400 – $9,300 – $26).

Of course, the actual savings will depend on your business category, location, sales, and expenses. You can use the CRA’s quick method calculator to estimate how much you can save by using the quick method.

6. Consequences of Failing to Register for GST/HST

If you are required to register for GST/HST and you fail to do so, you may face serious consequences from the CRA. These include:

- Having to pay GST/HST on all your taxable sales from the date you should have registered, even if you did not collect it from your customers

- Having to pay penalties and interest on any unpaid GST/HST

- Losing the right to claim ITCs for the GST/HST you paid on your business expenses

- Facing possible prosecution or fines for tax evasion

To avoid these consequences, it is important to monitor your sales and register for GST/HST as soon as you exceed the $30,000 threshold. If you are not sure whether you need to register or not, contact the CRA or consult a tax professional for guidance.

Conclusion

In conclusion, GST/HST is a crucial aspect of doing business in Canada. By following the guidelines outlined in this comprehensive guide, you’ll navigate the GST/HST registration process, stay informed about tax rates, file your returns appropriately, GST/HST compliance, and leverage input tax credits effectively. By staying informed and complying with GST/HST regulations, businesses can avoid penalties and ensure long-term success.