HST on Uber drivers

As a matter of fact, Uber transfers money earned by an uber driver to his bank account. But, one thing to notice here is that those earnings also have HST that is shown to CRA.

“There are a lot of uber drivers who do not have any idea that they are paying less HST. Moreover, the drivers become surprised when they see a huge amount in the form of HST. So, all that HST you are paying is claimable.”

Thus, if you are filing the taxes on your own or getting help from an accountant you should know the technique to save HST. In this article, we will provide you with some valuable information to save HST.

Following are the essential steps that must be fully considered.

1. Claiming HST on your expenses

When you register for HST you must know the fact that all of the expenses that you pay for your Gas, maintenance, oil changes, and phone, especially for an Uber rideshare business are claimable.

2. Method of collecting HST by Uber

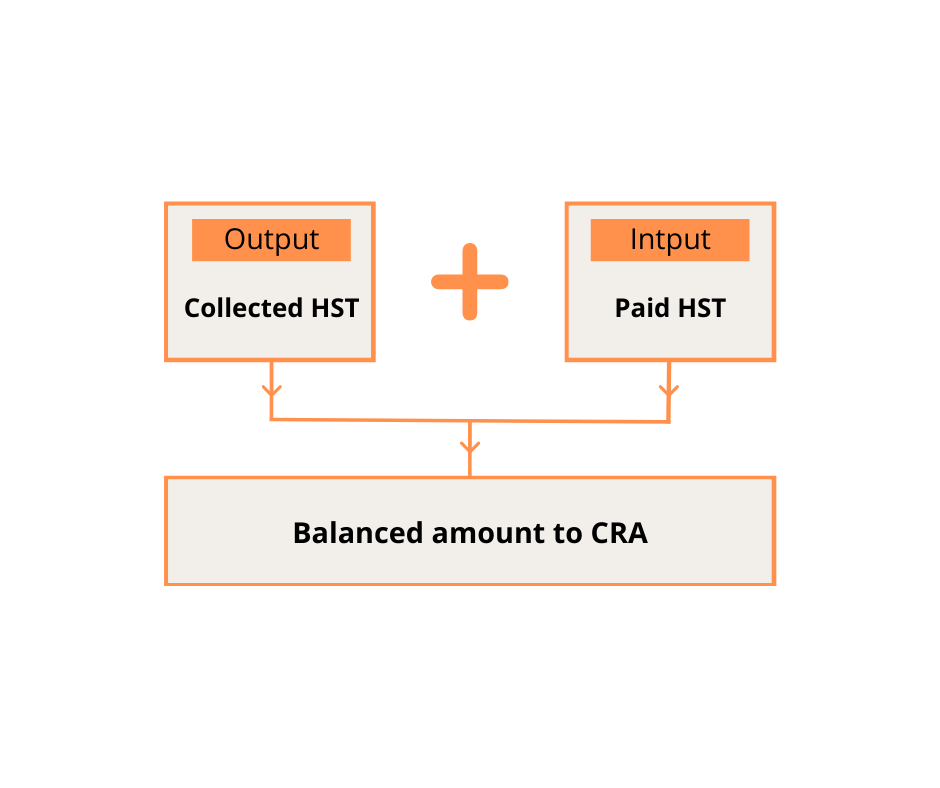

For all of your expenses, you are paying HST, and that HST is the one that you are going to claim against the HST being collected. This collected one is basically known as the output tax. While the one that we have paid in the form of expenses is said to be as the Input. So, the net amount of these two is the one that we send to CRA or to the Government.

3. Expenses that people forget to claim

HST on your car or CCA especially in the form of depreciation or CCA amount. You are eligible to claim for that HST. So, don’t forget to claim the ITCs on that specific amount, because it becomes a huge amount.

4. HST on services charged by Uber

One thing that must be followed by Uber drivers is that Uber charges the drivers for the services. For example, you are paying 20% of the fare as the service fee, so you are actually paying HST on that fee. You are eligible to deduct that HST as ITC. So, use it and claim it in your HST return.

Uber drivers should know the fact that your Uber fee is the thing on which you are paying HST as ITC for your tax return.

For 2021, Uber has started to mention HST on their fee. While Lyft used to do that since the beginning. If you look at the Lyft tax summary you will come to know that, they have mentioned it as a third-party fee.

5. HST on some other expenses

Sometimes you forget to claim your HST or GST on some expenses like tolls, parking, and some other expenses. But, you should have a look at those expenses.

Though these are smaller expenses but at least worthy. Therefore, to claim these you should keep their receipts or HST on any other such thing. You should claim it as your HST tax return for ITC.

So, this is all about saving HST when you are a Uber driver!