If you’re an employee in Canada, you’re likely familiar with the T4 slip, formally known as the Statement of Remuneration Paid. This document is essential for understanding your earnings and tax deductions from January 1 to December 31 of the previous year. In this guide, we’ll break down the T4 slip, understand your paycheck, and navigate the tax filing process with confidence.

Understanding the Basics of the T4 Slip

The T4 slip, also known as the “Statement of Remuneration Paid,” is a crucial document that your employer must provide to you and the Canada Revenue Agency (CRA) each year. This slip outlines the total amount you earned as an employee, as well as the various deductions and contributions that were made from your paychecks throughout the year. If you worked for multiple employers, you’ll receive a separate T4 slip from each one.

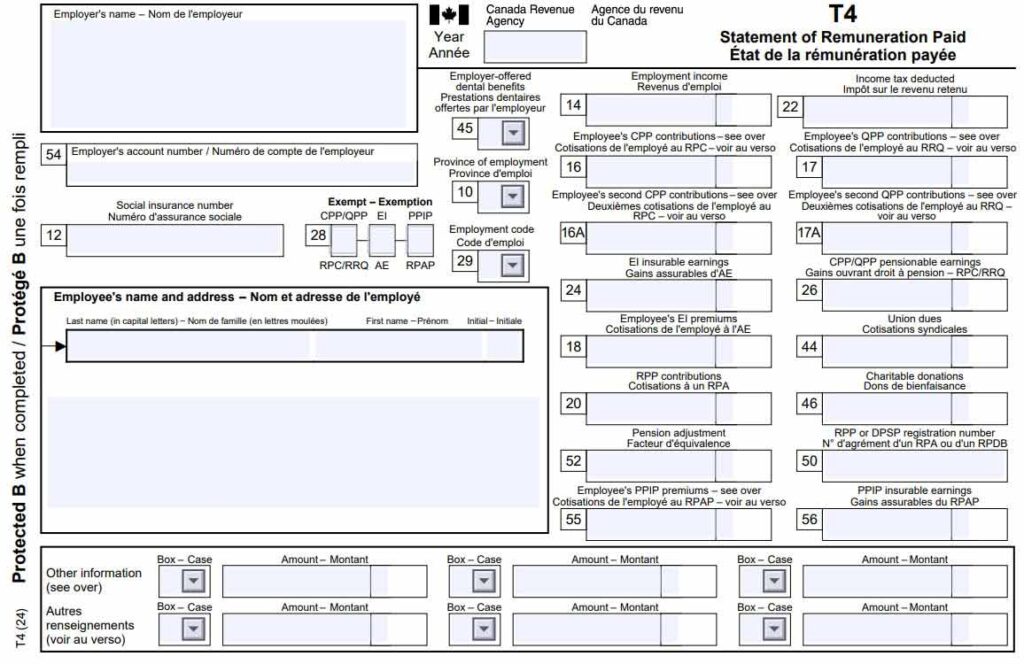

The T4 slip is divided into several sections, each providing important information about your employment and tax situation. Let’s dive into the key elements you’ll find on your T4 slip:

- Employer Information: This section includes the name, address, and the employer’s business number, as well as your social insurance number (SIN).

- Employee Information: Here, you’ll find your name and address as they appear on your employer’s records.

- Taxable Income and Deductions: This is the heart of the T4 slip, where you’ll find the various boxes detailing your gross salary, Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and income tax deductions.

- Other Amounts: Additional boxes may include information about union dues, pension plan contributions, and other benefits or allowances.

Why is the T4 Slip Important?

Your T4 slip is crucial when filing your tax return. It provides the necessary information to calculate your taxable income and determine if you owe additional taxes or if you’re due a refund. Understanding your T4 can also help you make informed decisions about your financial situation.

Calculating Taxable Earnings on Your T4 Slip

The most important number on your T4 slip is the Gross Salary (Box 14), which represents the total amount you earned from your employer before any deductions were made. This is the starting point for calculating your taxable income and determining your tax obligations.

However, the amount you actually received in your paychecks throughout the year (your “net pay”) is likely lower than the Gross Salary, due to the various deductions and contributions that were made. Let’s take a closer look at these deductions:

Canada Pension Plan (CPP) Contributions

As an employee in Canada, you are required to contribute a portion of your earnings to the Canada Pension Plan (CPP). This contribution is shown in Box 16 of your T4 slip and is a mandatory deduction from your paychecks. The amount contributed is based on a percentage of your CPP Pensionable Earnings (Box 26), which have an annual ceiling that is adjusted periodically.

It’s important to note that your employer is also required to match your CPP contributions, so the total amount going towards your future CPP benefits is double the amount shown in Box 16.

Employment Insurance (EI) Premiums

Another mandatory deduction from your paychecks is the Employment Insurance (EI) premium, which is shown in Box 18 of your T4 slip. This contribution helps fund the EI program, which provides benefits to eligible individuals who lose their jobs or are unable to work due to certain life events.

The EI premium is calculated based on your EI Insurable Earnings (Box 24), which have an annual ceiling that is also adjusted periodically.

Income Tax Deductions

The most significant deduction from your paychecks is likely the income tax that is withheld by your employer and remitted to the CRA on your behalf. This amount is shown in Box 22 of your T4 slip and is based on your Gross Salary (Box 14), your personal tax credits, and the tax rates applicable to your province or territory of residence.

It’s important to understand that the amount of income tax deducted from your paychecks throughout the year may not necessarily be the final amount you owe. Depending on your personal tax situation, you may receive a refund or owe additional taxes when you file your annual tax return.

Other T4 Slip Deductions and Amounts

In addition to the core deductions, your T4 slip may also include other amounts that are relevant to your tax situation:

Union Dues

If you are a member of a union, any dues or fees that were deducted from your paychecks will be reported in Box 44 of your T4 slip. These union dues are generally tax-deductible, so you can claim them when filing your tax return.

Pension Adjustments

If you participate in an employer-sponsored pension plan, the amount of your pension contributions will be reported in Box 52 of your T4 slip. This information is used by the CRA to calculate your available RRSP contribution room for the following year.

Taxable Benefits and Allowances

In some cases, your employer may provide you with certain benefits or allowances that are considered taxable income. These amounts will be reported in the “Other Information” section of your T4 slip, using the appropriate codes (e.g., Box 40 for taxable benefits).

It’s important to review these amounts carefully, as they may impact your overall tax liability and the deductions you can claim on your tax return.

Preparing Your Tax Return Using T4

Now that you have a solid understanding of your T4 slip, it’s time to start thinking about how to maximize your tax deductions and ensure you’re getting the most out of your tax return.

Claiming Charitable Donations

If you made any charitable donations during the year, the total amount will be reported in Box 46 of your T4 slip. These donations can be claimed as tax credits on your tax return, potentially reducing your overall tax liability.

Be sure to keep track of your charitable receipts throughout the year, as you’ll need them when filing your tax return. You can also refer to this blog post for more information on claiming charitable deductions as an employee in Canada.

Reporting World Income

If you have income from sources outside of Canada, such as investments or employment in another country, you’ll need to report this “world income” on your tax return. This blog post can provide you with the necessary information and guidance to ensure you’re complying with CRA requirements.

What to Do if You Don’t Receive Your T4 Slip

If you haven’t received your T4 slip by the end of February, it’s essential to contact your employer. Employers are required to issue T4 slips by the last day of February for the previous tax year. If you can’t get in touch, you can also check the CRA’s My Account online service, as your employer will have submitted a copy to the CRA as well.

Common Questions About the T4 Slip

Let’s answer some frequently asked questions regarding the T4 slip.

What if there are mistakes on my T4 slip?

If you spot any errors, contact your employer’s payroll department immediately. They can issue a corrected T4 slip if necessary. It’s critical to resolve these errors before you file your taxes to avoid complications.

Can I claim additional deductions on my T4 slip?

While your T4 slip outlines mandatory deductions, you may also have additional deductions you can claim, such as union dues, charitable donations, or expenses related to your job. Be sure to keep track of these amounts for your tax return.

Do I need to keep my T4 slip?

Yes, it’s crucial to keep your T4 slip for your records. The CRA requires individuals to retain their tax documents for a minimum of six years in case of an audit or review.

Conclusion

While understanding your T4 slip is an important first step, it’s always a good idea to consult with a tax professional, especially if you have a complex financial situation or are unsure about the deductions and credits you can claim. A qualified tax accountant can help you navigate the tax filing process, ensure you’re taking advantage of all available deductions, and minimize your tax liability. Happy filing!