As a business owner of a Canadian corporation, you understand that filing a T2 Corporation Income Tax Return is a non-negotiable legal requirement. But, what if your business had a slow year, is new or if you had absolutely no activity?

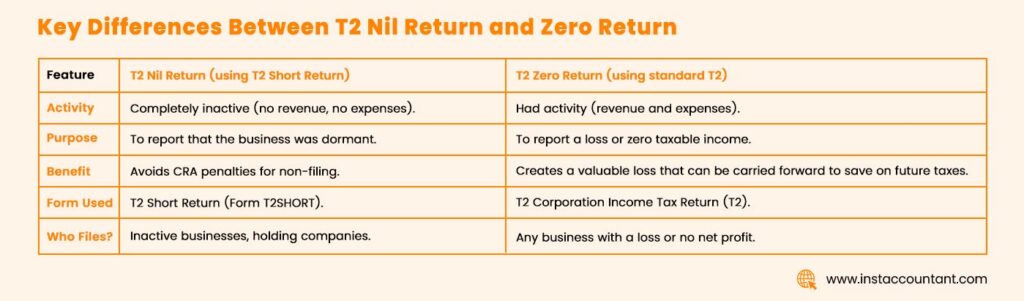

Here’s where you hear the terms “nil return” and “zero return”, and knowing the difference can save you from the hefty penalties from the Canada Revenue Agency (CRA).

The two are often confused and thought to be the same, but they are very different kinds of financial situations. This guide will clarify the differences between a T2 Nil Return and a Zero Return, explain who needs to file them and share expert tips for staying compliant and protecting your business.

What Is a T2 Nil Return? (Filing for Inactive Corporations)

The term “Nil Return” is not an official CRA designation but is widely used in the corporate tax world. A T2 Nil Return is a simplified tax filing for Canadian corporations with no income from any source, no expenses or costs of any kind and no bank transactions, no inventory and no business operations during the fiscal year. It’s a way of telling the CRA, “My company is still incorporated, but it’s been in a state of complete hibernation for the last 12 months.

The CRA requires all resident corporations except tax-exempt Crown corporations, Hutterite colonies and registered charities to file a T2 return annually, even if there’s no tax payable. The same applies to non-resident corporations that have done business in Canada, had taxable capital gains or disposed of taxable Canadian property.

Filing a Nil Return ensures your corporation remains in good standing with CRA and avoids costly penalties.

Who is Eligible to File a T2 Nil Return

To file a T2 Nil Return in Canada, your corporation must meet strict criteria:

- Be a Canadian-controlled private corporation (CCPC) with nil net income or a loss or be a tax-exempt organization.

- Have a place of business in only one province or territory.

- Not claim refundable tax credits (other than refunds of instalments paid).

- Not have taxable dividends paid to or from such company.

- Not having a permanent establishment outside of Canada.

- Report financials in Canadian currency.

If your corporation doesn’t check all these boxes, you’ll need to file a standard T2 return, even if your income is zero. Always consult a corporate tax accountant to confirm eligibility and avoid costly mistakes.

Who Needs to File a T2 Nil Return in Canada?

This is typically filed by holding companies that simply hold assets, or by newly incorporated businesses that are still in the planning phase and haven’t begun operations.

This is for corporations that are “dormant,” such as:

- A startup still in the planning phase that hasn’t officially launched.

- A holding company that holds assets and has no business operations.

- A corporation that was created but never used.

A true nil return means no bank account fees, no professional fees for the accountant to file the return, no software subscription costs, etc. Any of these would make it a “zero return.

Filing a Nil Return is a formal way of telling the CRA that your corporation is still a legal entity but had no financial activity for the year. Failing to file one can still result in late-filing penalties of up to $2,500, even with a zero balance.

How to File a T2 Nil Return

A T2 Nil Return is typically filed using the T2 Short Return (Form T2SHORT). This simplified form is designed for Canadian-controlled private corporations (CCPCs) with straightforward tax situations. This is a two-page form designed to make the process easy and quick.

This T2 Short Return form is perfect for businesses that are dormant or just starting out, like a tech startup waiting for funding or an IT contractor keeping their corporation open between gigs.

Note: As of tax years starting after 2023, the CRA requires most corporations, including those filing a T2 Short Return, to file electronically to avoid a $1,000 penalty.

What is a T2 Zero Return? (Filing for Profitless Corporations)

A T2 Zero Return is an informal term, not officially used by the CRA, but commonly referenced to describe a T2 return where the corporation had some activity (like expenses) but ended up with $0 taxable income after deductions or credits.

This situation is much more common for active small businesses.

Who Needs to File a T2 Zero Return in Canada?

To file a T2 Zero Return, your corporation typically doesn’t qualify for the T2 Short Return because it had some financial activity, such as:

- Your business earned income, but your legitimate business expenses (like vehicle costs, professional fees, office supplies, etc.) were equal to or greater than your gross income.

- You had a business loss from a previous year that you carried forward to offset your current year’s income.

- Your total expenses for the year were equal to or greater than your total revenue, resulting in a zero or negative taxable income.

- You deducted depreciation on your business assets (like a vehicle or equipment), bringing your taxable income down to zero.

Unlike a Nil Return, a Zero Return requires more detailed reporting. If your corporation had any activity, even a minor one, you’ll likely need to file a standard T2 return, which will detail all of your financial activity. Your final taxable income may be zero, but your filing will be a complete and accurate picture of your business.

Why is the Distinction Important?

Filing a T2 Zero Return is a vital tax strategy. Filing a T2 Zero Return (or a return with a net loss) allows you to report all of your deductible business expenses properly.

By meticulously tracking your expenses, even if they outweigh your income, you create a non-capital loss. This loss is a valuable asset. It can be carried back for up to 3 years to offset taxable income from a previous profitable year or carried forward for up to 20 years to offset future income. By carrying forward a loss, you can reduce or even eliminate your coming tax bill.

Many new business owners, particularly freelancers and contractors, mistakenly think that if they have no profit, they don’t need to file. This is wrong. By not filing a Zero Return and reporting your losses, you are giving up an opportunity to save thousands of dollars in taxes down the road.

The Costly Mistake: Mixing Up a Nil Return and a Zero Return

This distinction is crucial when choosing the correct form and avoiding CRA scrutiny. The biggest mistake Canadian corporation owners make is to file a T2 Nil Return when a T2 Zero Return should have been submitted.

For example, you’re a IT consultant and earned $5,000 but had $5,500 in deductible expenses. You think, “My income is zero, so I’ll just file a nil return.”

By filing a nil return, you have failed to report your $5,500 in expenses and your $500 business loss. That loss could have been carried forward to save you tax when you become profitable in the future. You’ve essentially left money on the table and have an incomplete financial record with the CRA.

The Bottom Line

The lesson here is simple: whether your corporation is generating millions of dollars or is completely inactive, you have a non-negotiable legal obligation to file a T2 return.

- File a T2 Nil Return if your corporation had zero financial activity.

- File a standard T2 return (a “Zero Return”) if your corporation had any income or expenses, and report all of your legitimate deductions to protect your future earnings.

The T2 filing deadline is always six months after the year-end of your corporation (If your corporation owes tax, the balance due date is earlier: 2 months after year-end (or 3 months for eligible CCPCs). Once you have understood the concept of Nil Return vs Zero Returns, you can save your business against penalties and also utilize your tax filings as a strategic tool for future success. If you’re ever in doubt, consider getting help from a corporate tax accountant, who can assist in interpreting these CRA rules and get your corporate tax prepared correctly.

FAQs

- Do I have to file a T2 if my corporation is inactive or dormant?

Yes. As long as your corporation is legally incorporated, you must file a T2 annually. Even if it’s dormant, inactive, or still in the planning stage. - Who can file a T2 Short Return in Canada?

Corporations with no income or a loss, a single Canadian business location, no refundable tax credits (except instalments), and no foreign permanent establishments. - When is my T2 return due?

Your corporation’s T2 return is due 6 months after your fiscal year-end, not April 30 like personal taxes. For example, if your year-end is December 31, your T2 is due by June 30 of the following year. - What are the penalties for not filing a T2 return?

The CRA can charge a penalty of $25 per day, up to a maximum of $2,500, for failing to file on time, even if your business had no income. - Can an inactive corporation skip filing a T2?

No. All resident corporations, including inactive and dormant ones, are required to file a T2 return annually to maintain a good standing with the CRA. - What is the T2 Short Return?

The T2 Short Return is a simplified, two-page form for eligible Canadian-controlled private corporations (CCPCs) that have a loss or no income for the year. It’s the form most commonly used for a T2 Nil Return. - How do I file a T2 return?

As of 2025, most corporations must file their T2 return electronically using CRA-certified tax software. Paper filing may result in a non-compliance penalty. - How much does it cost to file a T2 Nil or Zero Return?

We charge $110 for filing a T2 Nil Return and $220 for a T2 Zero Return.