Welcome to Canada! Whether you’ve just landed in Toronto as an international student, settled in Vancouver as a permanent resident, or arrived in Edmonton on a work permit, you’re starting an exciting new chapter. Understanding the Canadian tax system and how it impacts your financial well-being is absolutely crucial. The Canada Revenue Agency (CRA), your federal tax administrator, plays a significant role in your journey, not just in collecting taxes but also in delivering vital benefits and credits designed to support you and your family.

This comprehensive guide is tailored specifically for newcomers to Canada, demystifying key concepts such as residency status, immigration status and how to access the government benefits and credit payments to which you’re entitled. Get ready to navigate the Canadian financial landscape with confidence!

Who is a “Newcomer” According to the CRA?

For income tax purposes, the CRA considers you a newcomer to Canada for your first year as a resident. This means that from the moment you establish significant residential ties in Canada, you’re officially on the CRA’s radar as a resident taxpayer.

Even before you file your first tax return, you can often apply for crucial benefit and credit payments, including provincial and territorial payments, which provide valuable financial support as you settle in.

Residency Status vs. Immigration Status in Canada

Navigating your tax obligations and eligibility for benefits in Canada hinges on understanding two key concepts: your residency status and your immigration status. While often confused, they serve different purposes.

Residency Status:

Your residency status dictates your tax obligations in Canada. You become a resident of Canada for income tax purposes when you establish sufficient residential ties to the country. For most newcomers, this begins the very first day you start living here.

What are Residential Ties?

The CRA looks at a combination of factors to determine your residential ties, including:

- A home in Canada: Owning or renting a dwelling that is available for your occupation.

- A spouse or common-law partner in Canada: If your family resides here.

- Dependents in Canada: Such as children.

- Other significant ties: These can include personal property (e.g., car, furniture), social ties (e.g., club memberships, religious affiliations), economic ties (e.g., bank accounts, credit cards), and Canadian driver’s licenses or health insurance.

Taxes for International Students Studying in Canada:

If you’re an international student in Canada, your residency status is particularly important. While your primary purpose might be education, if you establish significant residential ties, you’ll likely be considered a resident for tax purposes and need to file Canadian taxes. The CRA has specific guidelines for international students to help determine their status.

Important Note: Your residency status can change from year to year based on your circumstances (e.g., length of stay, temporary or permanent departure). It’s vital to keep the CRA updated on any changes to ensure you receive the correct benefit and credit payments.

Immigration Status:

Your immigration status defines your legal right to live, work, or study in Canada. Unlike residency status, it doesn’t directly determine your tax obligations, but it does impact your eligibility for certain government payments.

Common immigration statuses for newcomers include:

- Permanent Resident: Individuals granted permanent resident status by Immigration, Refugees and Citizenship Canada (IRCC).

- Protected Person (Refugee): Individuals granted protected person status by IRCC or the Immigration and Refugee Board of Canada (IRB). (Note: Refugee claimants, while potentially residents for tax purposes, may not hold a valid immigration status permit until their claim is approved for certain benefits.)

- Temporary Resident: Individuals holding permits such as study permits, work permits, visitor records, or temporary resident permits issued by IRCC. This also includes those who apply to extend their permit before it expires.

The CRA uses both your immigration and residency statuses to determine if you qualify for and when you can start receiving government payments. For example, a temporary resident might become eligible for the Canada Child Benefit (CCB) after 18 months of residence, provided they maintain a valid permit.

Your Social Insurance Number (SIN) or Tax Number

Before you can work, receive benefits, or even open most bank accounts in Canada, you’ll need a Social Insurance Number (SIN). This nine-digit number issued by Service Canada. It’s essential for working in Canada, opening bank accounts and accessing government benefits and programs.

You can apply for a SIN with Service Canada. If, for some reason, Service Canada cannot issue you a SIN, the CRA may provide you with a Temporary Tax Number (TTN).

How the Canadian Tax System Works

Canada’s tax year follows the calendar year, from January 1 to December 31. Your completed Income Tax and Benefit Return (or “tax return”) is generally due by April 30 of the following year. If you or your spouse/common-law partner are self-employed, the filing deadline is June 15, though any taxes owed are still due by April 30.

Here’s how it works:

- Report Your Income: You declare all your earnings from Canadian and worldwide sources.

- Claim Deductions: These reduce the amount of income you’re taxed on.

- Claim Credits: These directly lower the amount of tax you have to pay.

- Calculate Your Tax: Based on your income, deductions, and credits, you’ll determine your federal and provincial/territorial tax.

- Determine Refund or Balance Owing: If too much tax was withheld from your pay, you’ll get a tax refund. If not enough, you’ll owe taxes.

If you have a job, your employer typically deducts taxes from your paycheque. You’ll receive tax slips (like a T4 for employment income) from your employer or other payers, which summarize your income and amounts withheld. These slips are essential for filing your tax return.

Remember to keep all your supporting documents for at least six years after you file, in case the CRA needs to review your return.

Benefit and Credit Payments for Newcomers to Canada

One of the most exciting aspects for newcomers is the potential to receive benefit and credit payments that can significantly ease your financial transition. These payments are designed to provide extra money for you and your family, and in many cases, you can apply for them as soon as you arrive, even before your first tax filing!

Each benefit and credit has its own purpose and requirements:

- Some require an application: Others are automatically calculated when you file your taxes.

- Payment frequency varies: Monthly, quarterly, or annually.

- Some are tax deductions: Reducing your taxable income.

- Amounts vary: Based on family income, or a fixed amount for all who qualify.

Start Getting Payments Before Your First Tax Return

You are generally not required to file your first tax return until the year after you become a resident for tax purposes. However, you can apply for benefit and credit payments as soon as you meet the eligibility criteria.

To apply, complete one of these forms:

- Form RC151, GST/HST Credit and Canada Carbon Rebate Application for Individuals Who Become Residents of Canada: Use this if you don’t have children to register. This also determines eligibility for related provincial and territorial programs.

- Form RC66, Canada Child Benefit Application: If you have children and meet the CCB eligibility requirements. Include RC66SCH Status in Canada and Income Information for the Canada Child Benefits Application. This form will also assess your eligibility for the GST/HST credit, Canada Carbon Rebate, and related provincial/territorial programs.

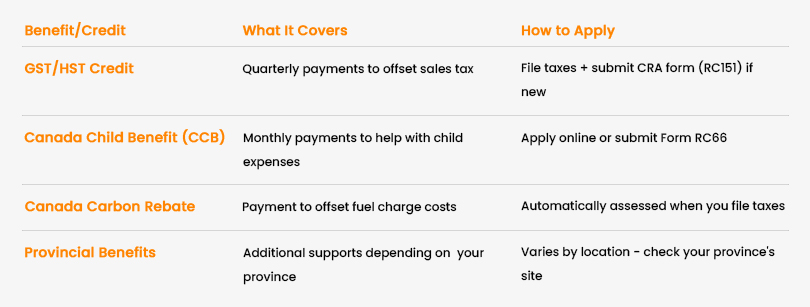

What CRA Benefits and Credits Newcomers Can Claim in Canada:

- Goods and Services Tax / Harmonized Sales Tax (GST/HST) Credit:

- A tax-free quarterly payment for low to modest-income individuals and families.

- Helps offset the GST/HST paid on goods and services.

- Eligibility for this often leads to eligibility for related provincial/territorial payments.

- Canada Child Benefit (CCB):

- A monthly tax-free payment to help with the cost of raising children under 18.

- Amounts vary based on family income and the child’s age.

- Eligibility for CCB can also make you eligible for certain provincial/territorial benefits for families with children.

- Canada Carbon Rebate (CCR) (formerly Climate Action Incentive Payment):

- A quarterly payment designed to offset the cost of federal pollution pricing in participating provinces.

- Newcomers can qualify once they’ve filed a tax return and met the residency requirement for at least six months.

- The amount varies by province and household size.

How to Stay Eligible for CRA Benefits and Tax Credits

To continue receiving benefit and credit payments, it’s crucial to:

- Do your taxes on time each year: Even if you have no income or don’t owe tax, your annual tax return is how the CRA calculates your payment amounts.

- Keep your information up to date with the CRA: Changes in address, marital status, children leaving your care, or expiring temporary resident permits must be reported promptly to avoid payment delays or interruptions.

CRA Benefit Payments You May Get After Filing Your Taxes

Once you file your first tax return, you may become eligible for additional payments:

- Child Disability Benefit: For families caring for a child under 18 who qualifies for the Disability Tax Credit (DTC).

- Canada Workers Benefit (CWB): A refundable tax credit for low-income working individuals and families.

- Tax Refund: If you paid more tax than you owed during the year.

How to File Your First Tax Return in Canada

Many newcomers mistakenly believe they don’t need to file a tax return if they haven’t earned income in Canada yet. This is a common pitfall! Filing your tax return is crucial because it’s how the CRA determines your eligibility for most benefits and credits.

What you’ll need to file:

- Social Insurance Number (SIN)

- Personal Information: Name, date of birth, address, marital status, and details of any dependents.

- Income Slips: T4 (employment income), T4A (other income), T5 (investment income), etc. (Your employer(s) and financial institutions will issue these by late February).

- Receipts: For eligible deductions or credits (e.g., medical expenses, childcare, moving expenses within Canada if applicable).

- Foreign Property Information (Form T1135): If you own foreign property (bank accounts, stocks, real estate) with a total cost exceeding CAD $100,000, you must file this form in subsequent years (not usually your first year of residency).

How to file your return:

- Certified Tax Software/By Paper:

- This is the fastest method. You can use NETFILE-certified tax software (some are even free!) to prepare and electronically submit your return to the CRA. Processing typically takes about two weeks. If you prefer, you can complete a paper tax package and mail it to the CRA. This usually takes at least eight weeks to process.

- Community Volunteer Income Tax Program (CVITP): If you have a modest income and a simple tax situation, volunteers at Community Volunteer Income Tax Program (CVITP) clinics can prepare your taxes for free. These are often available from March to April.

- Tax Preparer/Accountant: For more complex situations (e.g., foreign income, self-employment), consider hiring a professional.

Tax Deductions and Credits for Newcomers to Canada

When you file your tax return, you can reduce your taxable income by claiming deductions and lower your tax owing with credits.

Common Credits and Allowances:

- Spouse or Common-Law Partner Amount: If you supported your partner and their net income was below a certain threshold.

- Disability Tax Credit (DTC): For individuals with disabilities or those who support them.

- Home Buyers’ Amount: For purchasing a qualifying home in Canada.

- RRSP Deductions: Contributions to a Registered Retirement Savings Plan can reduce your taxable income.

- Donations and Gifts: For donations made to Canadian registered charities.

Common Expenses Claimed by Newcomers:

- Medical Expenses: Unreimbursed medical costs.

- Education Expenses: Tuition fees.

- Child Care Expenses: Costs incurred for eligible childcare.

- Moving Expenses: If you moved to Canada to work or start a business, and meet specific criteria.

For a comprehensive list of all eligible deductions, credits, and expenses, refer to the CRA’s official resources.

Protect Yourself and Your Information Online

- Manage Your Information with the CRA: Use My Account (the CRA’s secure online portal) to update your address, phone number, email, marital status and direct deposit information. You can also view your tax returns, benefit payment dates and check your refund status.

- Protect Yourself from Scams: Be vigilant! The CRA will never ask for personal information via text message, demand immediate payment through gift cards or cryptocurrency, or threaten arrest. If in doubt, log into My Account or call the official CRA phone number.

Don’t hesitate to seek professional help if you need it. A tax professional or accountant specializing in newcomer tax situations can provide personalized advice and ensure you’re maximizing your entitlements while staying compliant.