Welcome, fellow entrepreneur! You have taken a bold step by choosing to be self-employed or considering self-employment in Canada. You should be proud of yourself for following your dreams! But before you celebrate, there’s something you need to be aware of: Canadian self-employed taxes. I know, taxes are not the most exciting topic to discuss, but they are very crucial for your financial well-being and legal obligations. Believe me, you don’t want to have any trouble with the CRA (Canada Revenue Agency).

One of the difficulties is figuring out how to pay your self-employed taxes correctly and on time. Being a self-employed person, you have to deal with CPP (Canada Pension Plan), EI (Employment Insurance) and income tax, which have different rules and rates than for employees.

As an accountant, I’ve created this guide specifically tailored for beginners to understand self-employed taxes in Canada. In this blog post, I’ll explain what CPP, EI and income tax are, how they apply to self-employed people, and how to calculate and pay them. I’ll also share some tax tips and resources to help you save money and avoid penalties. By the end of this post, you’ll have a better understanding of your tax obligations as an Canadian self-employed and how to handle them like a pro.

How to Pay Taxes as an Self employed in Canada

First things first: what does self-employment mean in Canada? According to the CRA, self-employment is when you earn income from a business, profession, commission, farming, or fishing activity that you operate yourself or with a partner.

Being self-employed has many benefits, such as having more flexibility, autonomy, and creativity. You can also deduct certain expenses from your income to reduce your tax bill. However, being self-employed also comes with some responsibilities, such as keeping track of your income and expenses, paying taxes on time, and filing the right tax forms.

As an self-employed in Canada, you need to know how much to set aside for your taxes, especially for the Canada Pension Plan (CPP) and Employment Insurance (EI) premiums. Unlike employees, who have their taxes deducted from their paychecks, self-employed individuals have to calculate and pay their taxes themselves, either quarterly or annually. This can be challenging, especially if you are not familiar with the tax rules and rates for self-employed workers in Canada.

Types of Taxes in Canada for Self-employed

As a Canadian self-employed or independent contractor, you might be subject to two types of taxes: income tax and GST/HST.

1. Income tax is the tax you pay on your net income (your income minus your expenses) for the year. The amount of income tax you pay depends on your tax bracket, which is determined by your taxable income and your province or territory of residence. You can find the current tax rates and brackets on the CRA website.

As an self-employed, you need to file two forms for your taxes. The first one is the T1 General, which is the basic form for personal income tax. The second one is the T2125, which is the form for business or professional activities. On the T2125, you have to report:

- How much money you made from your business or profession

- How much you spent on goods and services for your business

- How much you deducted for depreciation and other expenses

- How much net income or loss you had from your business

2. GST/HST is the goods and services tax/harmonized sales tax that applies to most goods and services sold or provided in Canada. GST/HST is collected by businesses and remitted to the CRA. The rate of GST/HST varies depending on the province or territory where the sale or service takes place. You can find the current GST/HST rates on the CRA website.

When to Register for GST/HST as an Self-Employed

If you’re a Canadian self-employed or independent contractor and you sell goods or services that are subject to GST/HST, you might need to register for a GST/HST account with the CRA. This will allow you to collect GST/HST from your customers and remit it to the CRA.

You need to register for a GST/HST account if:

- Your total revenues from taxable supplies (before expenses) are more than $30,000 in a single calendar quarter or in four consecutive calendar quarters.

- You provide rideshare (Uber, Lyft) or delivery (UberEats, DoorDash) services.

- You sell goods or services outside Canada that would be taxable if sold in Canada

You can register for a GST/HST account online through the CRA website or by consulting with your tax accountant. You’ll need to provide some information about yourself and your business, such as your name, address, social insurance number, business number, and estimated annual revenues.

Once you register for a GST/HST account, you’ll receive a confirmation letter with your GST/HST number and reporting period. You’ll need to use this number when you issue invoices or receipts to your customers and when you file your GST/HST returns.

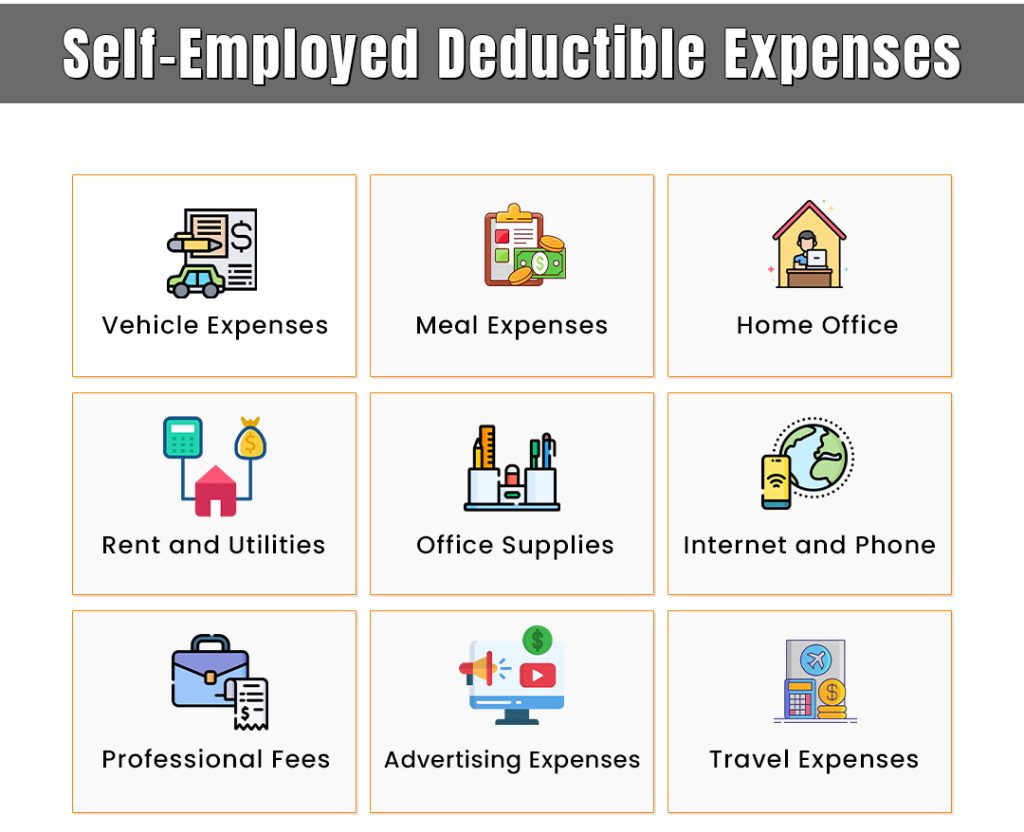

Tax Deductions for Canadian Self-Employed

One of the perks of being self-employed is that you can deduct certain expenses from your income to lower your tax bill. These are called business expenses and they include things like:

However, not all expenses are deductible. To be deductible, an expense must be both reasonable and related to your business activity. For example, you can’t deduct personal expenses like groceries or clothing (unless they’re uniforms).

To claim business expenses as an self employed or independent contractor, you need to keep track of them throughout the year. You should keep receipts, invoices, bank statements, and other records that show how much you spent and what you spent it on. You should also keep a logbook of your business mileage if you use your vehicle for business purposes.

Keeping track of your business expenses will help you prepare your income tax return and support your claims in case of an CRA audit.

How to File Your Self-employed Taxes in Canada

If you are self-employed, you need to know how to file your taxes correctly and efficiently. Filing your taxes as a self-employed individual can be different from filing as an employee. You need to report your income and expenses, calculate your taxes, and submit your tax return to the Canada Revenue Agency (CRA).

Here are some steps to help you file your taxes as an self-employed in Canada:

- 1. Determine your business structure: Depending on how you operate your business, you may be a sole proprietor, a partner, or a corporation. Your business structure affects how you report your income and expenses, and what forms you need to file.

- 2. Register for a business number: If you have a GST/HST account, a payroll account, or a corporate income tax account, you need to register for a business number with the CRA. A business number is a unique identifier for your business that helps the CRA track your tax obligations and payments.

- 3. Track your income and expenses: You need to keep accurate records of all your business income and expenses throughout the year. You can use accounting software, spreadsheets, or paper ledgers to record your transactions. You also need to keep receipts and invoices for all your business expenses.

- 4. Calculate your net income and taxes: Your net income is your total income minus your total expenses. You need to report your net income on your tax return and pay income tax on it. You also need to pay CPP contributions on your net income if you are a sole proprietor or a partner. If you are a corporation, you need to pay corporate income tax on your net income.

- 5. File your tax return: The final step in handling your self-employed taxes is filing your tax return with the CRA. As a self-employed individual, you have until June 15th of the following year to file your tax return. However, if you owe any taxes, you have to pay them by April 30th of the following year to avoid interest and penalties.

You can file your tax return online using the CRA’s NETFILE service or by mail using the CRA’s paper forms. You can also use tax software or hire a tax professional to help you with your tax return.

Filing your taxes can be a daunting task, but it doesn’t have to be. Here are some tips to make the process easier:

– Keep your records organized and up-to-date throughout the year.

– Make sure to claim all the deductible business expenses.

– File your tax return early to avoid stress and delays.

– Review your tax return carefully before submitting it to avoid errors and omissions.

– Pay your taxes on time to avoid interest and penalties.

You’ll also need to fill out Form GST34 if you’re registered for GST/HST. This form will help you calculate how much GST/HST you collected and paid, and how much you owe or are entitled to as a refund.

How to Fill T2125 Form for Self-employed Expenses

To file your self employed tax return, you’ll need to fill out Form T2125. Form T2125 is a statement of your business or professional activities, where you report your income and expenses, as well as your net income and taxable income. You can use Form T2125 to claim deductions for your business expenses, such as advertising, supplies, travel, and home office costs.

Form T2125 has six parts:

– Part 1: Identification – where you provide your name, social insurance number, business name, and address.

– Part 2: Business income – where you report your gross income from sales, commissions, fees, and other sources.

– Part 3: Cost of goods sold and gross profit – where you calculate your cost of goods sold and subtract it from your gross income to get your gross profit.

– Part 4: Business expenses – where you list and total your business expenses by category.

– Part 5: Net income (loss) before adjustments – where you subtract your total expenses from your gross profit to get your net income or loss.

– Part 6: Business-use-of-home expenses – where you claim a portion of your home expenses, such as utilities, property taxes, mortgage interest, and rent, as a business deduction.

Filling out Form T2125 can be complicated, especially if you have multiple sources of income or complex expenses. That’s why it’s a good idea to consult a professional accountant or tax preparer who can help you with the details and ensure you claim all the deductions you’re eligible for.

Conclusion

Filing your taxes as an self-employed correctly not only ensures compliance with the Canadian laws but also enables you to maximize deductions and minimize your tax liability. By understanding the key concepts and requirements outlined in this guide, you’ll be well-prepared to tackle your tax responsibilities as a self-employed individual. Remember to keep accurate records of your income and expenses, and familiarize yourself with the various deductions and credits available to you.

If you have any questions or concerns about your tax situation, I recommend that you seek professional advice from a qualified accountant, specifically one who specializes in self-employed taxes (like Instaccountant). We can help ensure that you’re taking advantage of all available deductions and credits, and help you navigate the complexities of self-employment taxes.

Good luck on your self-employed tax journey!