Understanding Canadian tax laws and regulations can be complex. Therefore, the CRA has established services to help individuals and businesses seeking clarification on various tax-related matters. Whether you are an individual tax filer or a business tax filer, the CRA offers dedicated services to address your specific needs.

Welcome to our friendly guide, where we will provide you with all the information you need about the best times to seek assistance for your Canada Revenue Agency (CRA) inquiries. We understand that dealing with CRA can sometimes feel overwhelming and the last thing you want is to spend hours on hold or waiting for a response. By knowing the specific timings for different help services, you can effectively manage your time, get the help you need, and minimize the stress involved in resolving your CRA inquiries.

General Inquiries for Individual Tax Filers

If you have questions regarding personal tax filing, such as deductions, credits, or deadlines, the CRA’s individual income tax and trust enquiries line is available to help.

- Timings: Monday to Friday, 9 am to 5 pm

- Contact: CRA’s Individual Income Tax and Trust Enquiries Line: 1-800-959-8281

Tip: For fewer call volumes, contact the CRA on Tuesdays or Wednesdays. Early morning (8:30 AM – 9:30 AM) or late afternoon (3:00 PM – 4:30 PM) are typically less busy times.

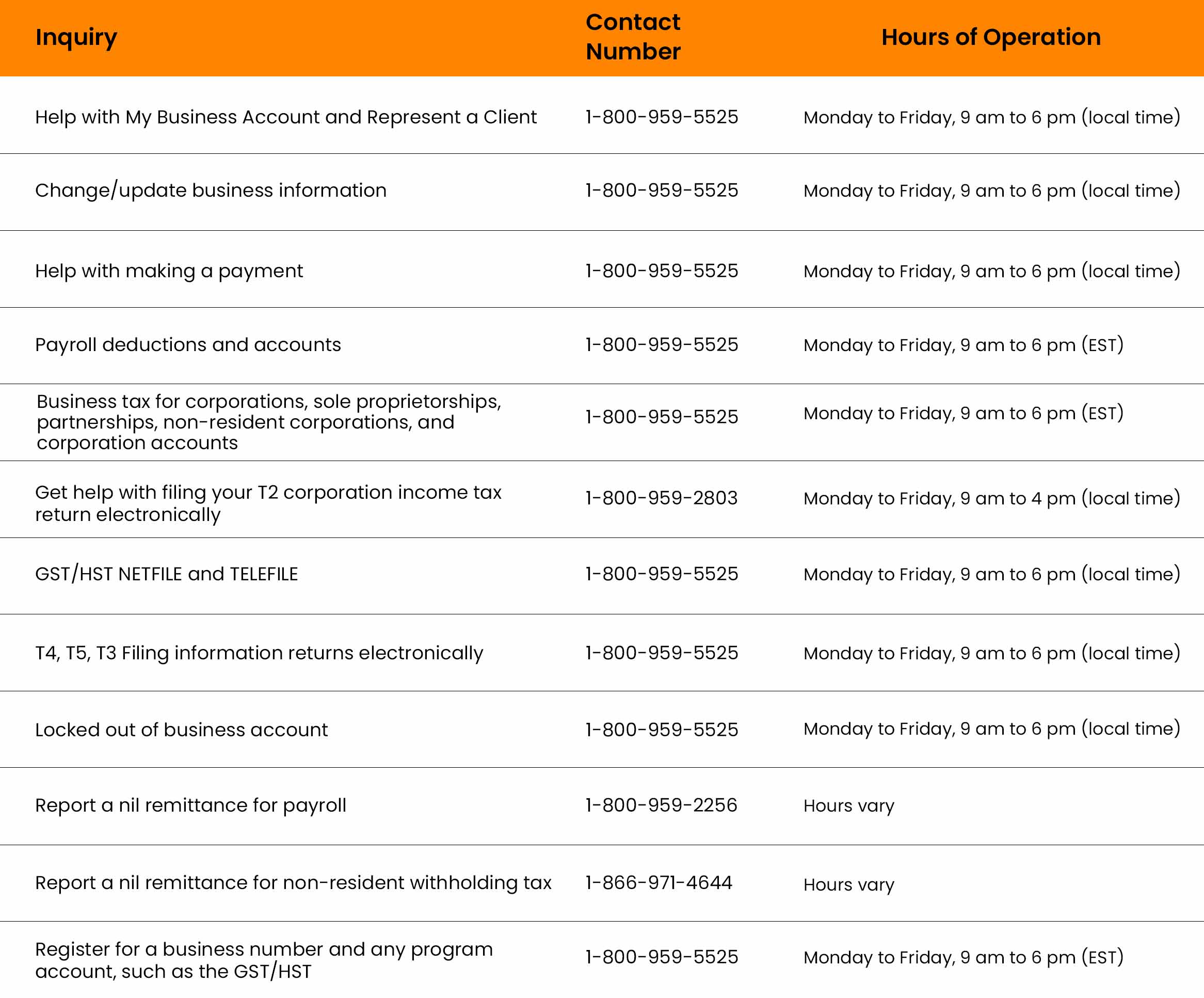

General Inquiries for Business Tax Filers

For businesses seeking guidance on tax-related matters like expenses, deductions, and compliance, the CRA’s business enquiries line is your go-to resource.

- Timings: Monday to Friday, 9 am to 6 pm

- Contact: CRA’s Business Enquiries Line: 1-800-959-5525

Tip: Similarly, calling on Tuesdays or Wednesdays during off-peak hours can result in shorter wait times.

My Account Online Support

If you prefer a self-service option, the CRA’s “My Account” portal offers online support available 24/7. This platform allows you to access your tax information and manage your account at your convenience.

- Contact: Visit the CRA website and access the “My Account” portal for assistance.

Tip: Regularly check your account for updates and use the online tools to manage your tax information efficiently.

Ideal Days and Times for Specific CRA Inquiries

When it comes to general inquiries and questions about taxes, it is advisable to call the CRA helpline on Tuesdays and Wednesdays. These days typically experience lower call volumes compared to Mondays and Fridays. Aim to call early in the morning (between 8:30 AM and 9:30 AM) or later in the afternoon (from 3:00 PM to 4:30 PM) to avoid peak times.

Resolving Issues with CRA

Dealing with tax-related issues can be stressful, but the CRA provides specific services to assist you efficiently.

- Debt Management Program: If you’re struggling with tax debt, the CRA’s Debt Management Program can help you find a solution.

- Timings: Monday to Friday, 8 am to 8 pm

- Contact: CRA’s Debt Management Program: 1-888-863-8657

- Collections Inquiries: For questions related to collections, reach out to the CRA’s dedicated collections inquiries line.

- Timings: Monday to Friday, 8 am to 8 pm

- Contact: CRA’s Collections Inquiries Line: 1-866-864-5823

- Appeals and Objections: If you received a notice of objection or want to appeal a CRA decision, contact the appropriate department during their operating hours.

- Timings: Monday to Friday, 8 am to 4 pm

- Contact: Contact the nearest Appeals Intake Centre or the phone number provided on your Notice of Objection.

General Inquiries for Individuals and Businesses

For general inquiries that are not specific to personal or business tax filing, the CRA’s general enquiries line is available.

- Timings: Monday to Friday, 9 am to 6 pm

- Contact: CRA’s General Enquiries Line: 1-800-959-8281

Scientific Research and Experimental Development (SR&ED) Program

For businesses involved in scientific research and experimental development, the CRA’s SR&ED program can provide assistance and guidance.

- Timings: Monday to Friday, 9 am to 5 pm

- Contact: CRA’s SR&ED Program: 1-866-507-7778

Conclusion

By knowing the best times to reach out to the CRA and having the correct contact information at your fingertips, you can streamline your inquiries and resolve your tax matters more efficiently. Whether you need help with filing, managing debt, or understanding specific tax issues, the CRA offers a variety of services tailored to your needs. Utilize this guide to navigate CRA services effectively and minimize the stress associated with tax-related inquiries.