Tax season in Canada often comes with a rush of dates and deadlines, but keeping track of them is the best way to avoid stress and keep your finances on track. With the 2026 tax season for the 2025 tax year approaching soon, now is the time to learn when the Canada Revenue Agency (CRA) opens for filing and which deadlines are most important.

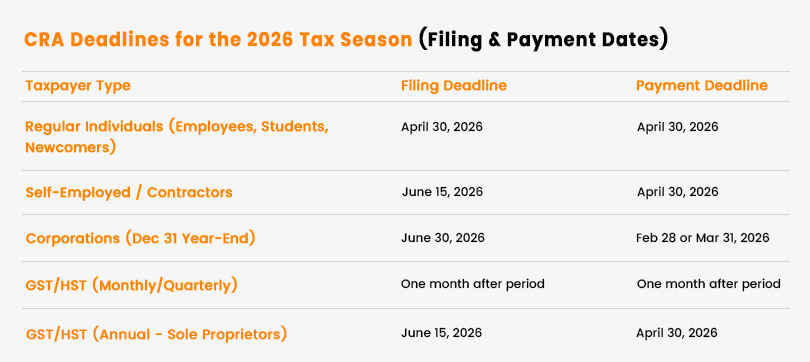

Whether you’re an individual taxpayer, self-employed contractor, student, newcomer to Canada or running a corporation, different rules and deadlines apply to your specific situation.

The timing of when you can file your 2025 tax return in Canada isn’t just about getting it done early; it impacts when you get your refund, whether you’ll owe penalties and how well your whole tax experience will go. Let’s break down everything you need to know about filing taxes in Canada, including the 2026 tax season deadlines and expert tips to make sure you’re ready.

Difference Between Tax Year and Filing Season in Canada

First, let’s address a common source of confusion: the tax year vs. the filing season. The 2025 tax year refers to all the income you earned and the deductions and credits you can claim from January 1, 2025 to December 31, 2025. The filing season, or “tax season,” is the period in which you prepare and submit your tax return for that specific year. For the 2025 tax year, the filing season will begin in early 2026.

When Can I File 2025 Tax Return in Canada?

The Canada Revenue Agency (CRA) officially opens tax season on February 24, 2026. This is when you can begin electronically filing your 2025 tax return through NETFILE, certified tax software or professional tax preparers. Before this date, the CRA’s systems simply won’t accept tax returns, so there’s no benefit to trying to file earlier.

The February 24th start date applies to all Canadian taxpayers, regardless of your employment status, income level or residency situation. Whether you’re a student filing your first tax return or a seasoned business owner with complex finances, everyone waits until the same opening bell.

Why Does Canada’s Tax Season Start So Late?

Many Canadians ask why they can’t file their taxes immediately after December 31. The answer is simple: employers, banks and other organizations need time to prepare and distribute tax slips, such as T4s, T5s, and T3s. These slips have important details for your tax return and the CRA also needs time to update their systems.

Key tax slip deadlines that affect when you can file:

- T4 slips (employment income): Must be issued by February 28, 2026.

- T5 slips (investment income): Must be issued by February 28, 2026.

- T3 slips (trust income): Must be issued by March 31, 2026.

- RRSP contribution receipts: Must be issued by March 3, 2026 for contributions made in the first 60 days of 2026.

Individual Taxpayer Deadlines: Employees, Students and Most Canadians

For the majority of individual taxpayers in Canada, including employees, students, retirees, and those with simple tax situations, the regular filing deadline remains the same every year. The filing due date is April 30 for most taxpayers, which means your 2025 tax return must be submitted to the CRA by April 30, 2026. This deadline applies whether you owe money to the CRA or are expecting a refund.

Who Falls Under the Individual Taxpayer Category?

Employees: If you receive a T4 slip from an employer and don’t have self-employment income exceeding $30,000, you’re considered an individual taxpayer. This includes full-time workers, part-time employees, and seasonal workers.

Students: Whether you’re in high school, college or university, if you had any income during 2024 (including part-time jobs, internships, or scholarships), you should file a tax return. Even if you made very little money, filing can help you:

- Build RRSP contribution room for future years.

- Receive GST/HST credit payments.

- Get the Canada Workers Benefit if eligible.

- Carry forward tuition tax credits for future use.

Students with only employment income (T4 slips) follow the standard April 30th deadline. However, students who had self-employment income from tutoring, freelancing or other contract work may qualify for the extended filing deadline discussed in the self-employed section below.

Retirees and Pensioners: If you’re receiving CPP, OAS, pension income or RRIF withdrawals, you’re typically an individual taxpayer with the April 30th deadline.

Newcomers to Canada: If you became a Canadian resident during 2025, you generally follow individual taxpayer rules for your first tax return. However, your situation may be more complex if you have foreign income or assets, so professional guidance is often recommended.

Payment Deadline vs. Filing Deadline

Here’s an important distinction many Canadians miss: while your tax return is due April 30, 2025, any money you owe must also be paid by April 30th to avoid interest charges. If you can’t pay the full amount, you should still file your return on time to avoid late-filing penalties, which are much more severe than interest on unpaid balances.

Self-Employed and Contractor Tax Deadlines

Self-employed people, freelancers, and independent contractors are the only ones who are given extra time to file tax returns, but the payment deadline remains the same as that of individual taxpayers.

Tax Filing Deadline for Self-Employed:

If you or your spouse/common-law partner had self-employment income in 2025, your tax return deadline extends to June 15, 2026. This extended deadline recognizes that self-employed individuals often have more complex tax situations requiring additional time to organize business records and calculate deductions.

Who qualifies for the extended filing deadline:

- Sole proprietors operating unincorporated businesses

- Independent contractors and consultants

- Freelancers in any industry

- Partners in business partnerships

- Commission-only salespeople

- Uber drivers, delivery drivers and gig economy workers

- Anyone with rental property income as a significant income source

- Spouses of self-employed individuals (even if they’re not self-employed themselves)

The Payment Deadline Stays April 30th

This is the most crucial detail. Even though you have until June 15th to file your return, if you have a balance owing, you must pay it on or before April 30, 2026. If you pay after this date, the CRA will charge daily compound interest on the unpaid balance. The CRA’s prescribed interest rates fluctuates quarterly, but it typically ranges from 5% to 7% annually, making late payments costly.

This means you need to estimate your tax liability and make a payment by April 30th, even if you haven’t completed your tax return yet. A self-employed tax professional‘s advice can be valuable in these situations to avoid unnecessary interest charges.

CRA Quarterly Installment Payments

If your net tax owing (federal and provincial combined) was more than $3,000 in 2025 and either 2024 or 2023, you’re required to make quarterly installment payments. For the 2025 tax year, these are due:

- March 15, 2026

- June 15, 2026

- September 15, 2026

- December 15, 2026

Self-Employed Tax Planning Strategies

- Set aside 25-30% of business income for taxes throughout the year.

- Work with a tax accountant to estimate year-end tax liability by March.

- Consider making voluntary payments throughout the year to reduce the April 30th burden.

Corporation Tax Deadlines and Requirements

Corporate taxation in Canada operates on a completely different timeline from personal taxes, with deadlines based on the corporation’s fiscal year-end rather than the calendar year.

T2 Corporate Tax Return Filing

Corporations must file their T2 tax return within six months of their fiscal year-end. Most corporations choose a December 31st fiscal year-end. However, many corporations choose different fiscal year-ends for business reasons, which affects their specific deadline.

Common corporate fiscal year-ends and their 2026 deadlines:

- December 31, 2025, year-end: File by June 30, 2026.

- March 31, 2026, year-end: File by September 30, 2026.

- Future year-ends: Six months after the specific fiscal year-end date.

Corporate Tax Payment Deadlines

The payment timeline for corporate taxes depends on the type of corporation and its income level:

Canadian-Controlled Private Corporations (CCPCs) eligible for small business deduction:

- Balance due two months after the fiscal year-end.

- For December 31, 2025 year-end, payment due February 28, 2026.

All other corporations:

- Balance due two months after the fiscal year-end.

- Monthly installment payments are required if tax owing exceeds $3,000.

Electronic Filing Requirements

Most corporations have to file their T2 returns electronically. CRA requires electronic filing to be mandatory for corporations with over $1 million in gross revenue or those that have filed electronically in previous years.

GST/HST Filing Deadlines

Goods and Services Tax/Harmonized Sales Tax (GST/HST) operates independently of income tax, with its own registration requirements and filing deadlines.

Who Must Register for GST/HST

Mandatory GST/HST registration applies if:

- Your worldwide taxable sales exceed $30,000 over four consecutive calendar quarters.

- You provide taxi or limousine services (including rideshare like Uber).

- You’re a non-resident making taxable sales in Canada.

Voluntary GST/HST registration is available if:

- Your taxable sales are under $30,000, but you want to claim input tax credits (ITCs).

- You export goods or services and want to claim refunds.

GST/HST Filing Frequency and Deadlines

The frequency of your GST/HST filings depends on your annual taxable sales:

Annual Filing (Sales under $1.5 million):

- Due one month after your fiscal year-end.

- Businesses with a calendar year would file by January 31, 2026 for 2025 activity.

Quarterly Filing (Sales between $1.5 million to $6 million):

- Due April 30, 2026 for the 1st Quarter (Jan-Mar).

- Due July 31, 2026 for the 2nd Quarter (Apr-Jun).

- Due October 31, 2026 for the 3rd Quarter (Jul-Sep).

- Due January 31, 2027 for the 4th Quarter (Oct-Dec).

Monthly Filing (Sales over $6 million):

- Due one month after the reporting period ends.

- January 2024 activity: Due February 28, 2025.

Note for Self-Employed Annual Filers: If you are self-employed and have a December 31 year-end and a GST/HST reporting period, your GST/HST deadline is June 15, but the payment is still due April 30.

Special Considerations for Small Businesses

Small businesses can often benefit from simplified GST/HST reporting methods:

- Quick Method: This option allows the business to remit only a percentage of sales and does not require tracking input tax credit receipts. This can simplify bookkeeping significantly for eligible businesses.

- Streamlined Accounting: his option is available to charities and certain non-profits, allowing simplified record-keeping and reporting.

Special Situations and Deadlines

- Deceased Persons: The final tax return for someone who passed away in 2025 is due on April 30, 2026, or six months after the date of death, whichever is later.

- Non-Residents and Emigrants: Non-residents who earned Canadian-source income must file by April 30, 2026, or June 15, 2026, if they had self-employment income.

- Trust Returns: Most trusts have to file T3 returns within 90 days of their fiscal year-end. For a calendar year-end (December 31, 2025), the filing deadline is March 31, 2026.

CRA Penalties and Interest for Missing Deadlines

Understanding the financial consequences of missing tax deadlines can motivate individuals to file and pay their taxes on time.

Late-Filing Penalties

- Individual taxpayers: 5% of unpaid tax plus 1% per month for up to 12 months. If you’ve been charged a late-filing penalty in any of the three previous years, the penalty increases to 10% plus 2% per month.

- Corporations: Varies based on taxable income, but can range from $25 per day to significant percentages of unpaid tax.

Interest on Unpaid Balances

The CRA charges compound daily interest on unpaid tax balances. As of 2025, prescribed interest rates are:

- Amounts owing to the CRA: 9% annually.

- Refund interest paid by CRA: 7% annually.

These rates are adjusted quarterly and can significantly increase your tax debt over time.

Strategies to Avoid CRA Penalties and Interest

- File even if you can’t pay: Late-filing penalties are much more severe than interest on unpaid balances. Always file your return by the deadline, even if you can’t pay immediately.

- Request penalty relief: CRA has taxpayer relief provisions for extraordinary circumstances like serious illness, natural disasters or significant financial hardship.

- Set up a payment plan: If you owe and can’t pay, contact CRA to set up a payment plan before the deadline.

Maximize Your Tax Refund in 2026

Timing Your RRSP Contributions

You have until March 3, 2026, to make RRSP contributions that can be deducted on your 2025 tax return. This 60-day grace period after year-end allows strategic tax planning:

- Calculate your optimal contribution: Use your Notice of Assessment to determine your maximum deductible amount.

- Consider income splitting: Higher-income spouses can contribute to spousal RRSPs for future income splitting opportunities.

- Maximize employer matching: If your employer offers RRSP matching, ensure you’re contributing enough to receive the full match.

Medical Expense Strategies

Medical expenses can be claimed for any 12-month period ending in 2025. This flexibility allows you to:

- Choose your optimal period: Choose the 12-month period with the highest medical expenses.

- Combine family expenses: You can claim medical expenses for yourself, your spouse and dependent children.

- Plan major medical purchases: If you need major dental work or medical equipment, timing it right can maximize your deduction.

Charitable Donation Timing

- Carry forward unused donations: You can carry forward unused charitable donation credits for up to five years, allowing strategic timing of claims.

- Donate securities: Donating appreciated stocks or mutual funds eliminates capital gains tax while providing a full donation credit.

- December 31st deadline: Unlike some deductions, charitable donations must be made by December 31st to claim in that tax year.

How to Prepare for 2026 Tax Season in Canada

Documents to Gather Now

Employment income:

- T4 slips from all employers.

- T4A slips for other income (employment insurance, pensions, self-employment).

- Record of Employment (ROE) if you received EI benefits.

Investment income:

- T5 slips for interest and dividend income.

- T3 slips from trusts and mutual funds.

- Investment account statements showing capital gains/losses.

Business income (if self-employed):

- All business income records.

- Business expense receipts and records.

- Vehicle expense logs for business use.

- Home office expense calculations.

Deduction receipts:

- RRSP contribution receipts.

- Medical expense receipts.

- Charitable donation receipts.

- Tuition and education expense receipts.

- Child care expense receipts.

Technology and Filing Options

Free software options:

- NETFILE-certified free software for simple returns.

- Community volunteer tax clinics for low-income individuals.

- CRA’s online services for basic returns.

Professional preparation:

- Accountants and tax professionals for complex situations.

- Tax preparation chains provide a standardized service.

- Online professional services for remote preparation.

What’s New for 2026 Tax Season?

The CRA continues to implement changes to simplify the tax filing process and introduce new tax policies that will impact Canadians’ returns for the 2025 tax year. Here are the key CRA updates to be aware of.

Digital Services Enhancements

The CRA continues to invest in digital services to make tax filing easier:

- Improved My Account features: Enhanced online account management with better mobile accessibility.

- Auto-fill services: Expanded partnerships with employers and financial institutions for automatic tax slip information.

- Real-time processing: Faster refund processing for electronically filed returns with direct deposit.

Tax Policy Changes

- Lowest Federal Tax Rate Reduction: The lowest personal income tax rate is reduced from 15% to 14%, effective July 1, 2025. This results in an effective full-year rate of 14.5% for the 2025 tax year.

- Capital Gains Inclusion Rate: The increase to the capital gains inclusion rate (from one-half to two-thirds) has been deferred. It is now proposed to take effect on January 1, 2026, and will not impact your 2025 tax return.

- Lifetime Capital Gains Exemption (LCGE): The LCGE limit has been increased to $1.25 million for eligible dispositions on or after June 25, 2024.

- Canada Carbon Rebate: As of March 15, 2025, the government has stopped the Canada Carbon Rebate for individuals. The final quarterly payment for the 2024 tax year was issued in April 2025.

When to Seek Tax Professional Help

Filing taxes in Canada can be straightforward if you’re an employee with a single T4 slip. But once life gets more complex, a tax professional isn’t just helpful, it’s essential. Here are some clear “yes, get help” situations:

- Complex business structures: Multiple corporations, partnerships or trust involvement requires professional expertise.

- International income: Foreign income, tax treaties and residency determinations need specialized knowledge.

- CRA disputes: Audits, reassessments or penalty disputes benefit from professional representation.

- Major life changes: Divorce, death in family, immigration or significant asset sales create complex tax situations.

Final Thoughts

Filing your 2025 tax return in Canada doesn’t have to be a stressful annual event. By knowing the important dates, preparing your documents early and understanding which CRA deadlines apply to you, you can handle tax season with confidence.

Remember these key takeaways:

- Tax season opens February 24, 2026 for everyone.

- Most individual taxpayers have until April 30, 2026 to file and pay.

- Self-employed individuals get until June 15, 2026 to file but must pay by April 30th.

- Corporations follow their own fiscal year-end schedules.

- GST/HST has separate deadlines based on filing frequency.

Whether you’re a first-time filer or a seasoned taxpayer, staying organized and meeting CRA deadlines for 2025 tax year protects you from penalties while ensuring you claim all available deductions and credits. When in doubt, don’t hesitate to seek professional accountant help. The cost of expert advice is almost always less than the cost of mistakes or missed opportunities.

FAQ

- As a international student in Canada, do I have different filing rules?

Students generally follow the same rules as individuals (April 30 deadline). If you have self-employment income (e.g., side gigs), you may be subject to the June 15 deadline for filing but still need to pay by April 30. - What happens if I’m self-employed but don’t owe any tax?

Even if you expect a refund, you must still file by the deadline to access benefits and avoid late-filing penalties. - If I moved to Canada partway through the year, when do I need to file?

You must file a return for the year you became a resident. You’ll report worldwide income from the date of residency onward. It’s crucial to determine your “residency for tax purposes” and file to access benefits like the GST/HST credit. - What is a Canadian-Controlled Private Corporation (CCPC)?

A CCPC is a Canadian corporation that meets specific ownership and income thresholds. If your corporation qualifies, it is eligible for the Small Business Deduction (SBD) and may have an extended payment deadline (three months instead of two) for its taxes. - How are GST/HST reporting periods determined?

The CRA assigns your reporting period (monthly, quarterly, or annually) based on your annual taxable sales. Even if you have “nil” activity, you must file your GST/HST return by the deadline. - Can CRA penalties or interest be waived?

Yes, but only in certain cases. The CRA may grant taxpayer relief for extraordinary circumstances, such as serious illness or natural disasters. You must apply for this relief and it is not guaranteed. It’s always best to file on time and pay as much as you can.