If you earn money through Uber, DoorDash, SkipTheDishes, Instacart or any other platform, the way your income is tracked, reported and audited in Canada has fundamentally changed.

For years, the system relied on the honor code. You earned cash, you reported it (hopefully) and the CRA had no way to know exactly what you made unless you told them.

That era is dead.

After new legislation (Bill C-47), the Canada Revenue Agency has implemented mandatory reporting for the 2025 tax year that fundamentally changes the game. The government now has a direct line to your earnings data.

If you want to avoid penalties, interest, and a stressful audit, you need to understand exactly how these new rules impact your bottom line.

Let’s break down what’s changing, what the CRA now knows and how to keep more of your money.

How the CRA Tracks Uber, DoorDash & Instacart Income

Before 2025, the CRA relied on what you self-reported on your tax return. If you “forgot” to include that $5,000 you made from a side hustle, the chances of getting caught were slim.

Now, the CRA has a backup system. Digital platforms are legally required to report you.

Under the new rules, gig platforms (rideshare, delivery, accommodation, freelance services) must collect and report your data directly to the CRA. This creates an automatic cross-reference system. If you report $40,000 on your tax return but Uber reports $55,000, your return will be flagged instantly.

Everything Your Platform Reports to the CRA Under Part XX Rules

By January 31, 2026, platforms like Uber, DoorDash and Instacart must submit their annual information returns to the CRA covering every dollar you earned in 2025. This data is now automatically cross-referenced with your personal tax filing, leaving zero room for ‘estimation’ or missing income.

This includes a wide range of services, from rideshare to e-commerce to freelancing.

Here’s the specific information these platforms must share with the CRA:

- Your full name, home address and date of birth.

- Your Social Insurance Number (SIN).

- The total gross income you earned through the platform.

- The number of transactions you completed.

- Your payment method details.

Do You Meet the 2,800 Reporting Threshold?

Platforms are required to report this information if you met both of the following thresholds in a calendar year: you completed 30 or more activities on the platform and earned more than $2,800 CAD. If you meet these conditions, the platforms must send you a copy of the information they send to the CRA.

GST HST Rules for DoorDash and Instacart Delivery

This is where many gig workers get caught off guard. Generally, if your total taxable sales are more than $30,000 over four calendar quarters, you must register for and collect GST/HST on your services. If you’re earning $625 per week through gig work, you’ll hit that threshold in less than a year. Once you cross this line, you’re not just reporting income, you’re now a GST/HST collector for the government.

Why Uber Rideshare Drivers Must Register for GST/HST

For Rideshare Drivers: If you are a rideshare (Uber, Lyft, Uride) driver, the rules are even stricter. The CRA classifies your services as a “taxi business,” which means you must register for and collect GST/HST from your very first fare, regardless of how much you earn. There is no $30,000 small supplier threshold for rideshare drivers.

Top 2026 Tax Tips for Uber and Instacart Drivers

The new reporting rules force a reality check on your tax strategy, but they also offer a clear path to compliance and financial confidence.

- Track Everything From Day One: Don’t wait until tax season. Now that the CRA knows your gross income, your job is to maximize legitimate deductions. Every kilometre driven, every software subscription, every phone bill, and every supply purchase is a potential deduction. Use a mileage-tracking app to automate this process and a cloud-based folder to store all your digital receipts.

- Understand Your True Income: The platforms report your gross income (before any of their fees or commissions). On your tax return, you must first report this gross amount on Form T2125 (Statement of Business or Professional Activities). You will then list all the fees as a business expense to arrive at your net income. This shows the CRA you’re being transparent and organized.

- Consider Professional Help: The rules are complex, and the consequences of misfiling are significant. For a small investment, a professional accountant can help you navigate these CRA tax changes, ensure you’re compliant, and find every eligible deduction so you can save money and focus on your business.

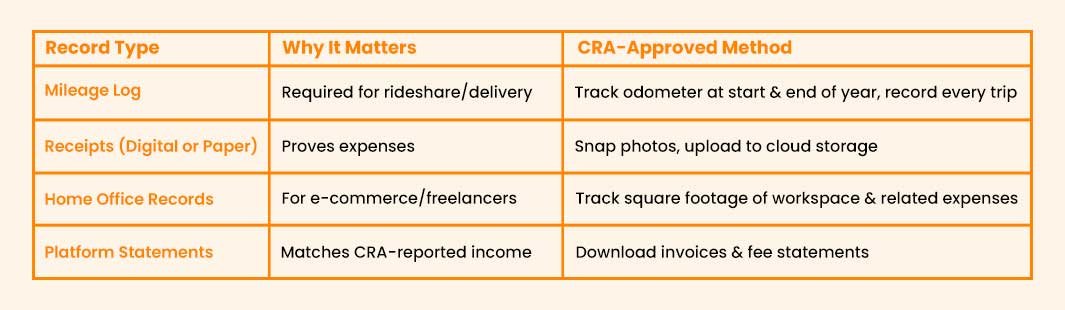

Audit Proof Your Return with These Mandatory CRA Records

The CRA is clear: if you can’t prove it, you can’t deduct it.

The CRA wants you to keep all your tax records for six years after the end of the tax year. So, if you file your 2025 return, don’t toss those receipts or mileage logs until at least December 31, 2031. To make life easier, try using the Zoombooks app.

How to Complete Form T2125 for Uber and Gig Income

As a self-employed driver, you will report your income and expenses on your personal tax return using Form T2125.

- Step 1: Report Gross Income. On Form T2125, you must report the total gross income from your platform, before any fees are taken out.

- Step 2: List Your Expenses. You will then list all your eligible business expenses in the relevant sections of the form. (Watch this video)

- Step 3: Calculate Net Income. The form will calculate your net business income (gross income minus expenses), which is the amount you will pay income tax and CPP contributions on.

- Step 4: Remit GST/HST. If you are a GST/HST registrant, you must file a separate GST/HST return and remit the net amount owed.

The Future of Canada Gig Economy Taxes

This Is Just the Beginning. The gig economy is here to stay, and the CRA’s new reporting requirements are likely just the first step in increased scrutiny of gig work taxation. The platforms are already sharing your data. Your new mission is to make sure you’re ready to justify every dollar you earned and every expense you claim.

The message is clear: the days of “forgetting” to report your gig work income are over. The CRA’s ability to compare what you report with what the platforms report will make it easier to flag returns with discrepancies.

This means that whether your side hustle is a small hobby or a full-time business, accurate reporting is no longer just a recommendation, it’s a necessity to avoid penalties, interest charges and a stressful CRA audit.