Driving for Uber while working a full-time or part-time T4 job is extremely common in Canada. Nurses, IT professionals, warehouse workers, students and office employees often use Uber to earn extra income on evenings or weekends.

But this mix creates confusion every tax season.

Many Uber drivers assume Uber income is “side money” that doesn’t affect their T4 taxes. Others don’t realize they’re considered self-employed by the CRA, even if Uber is not their main job.

If you have a T4 slip from an employer and Uber driver income, here’s how taxes actually work in Canada, what the CRA expects, what you can deduct and where most drivers get it wrong.

Uber Income is Self-employment Income in Canada

One of the most searched questions is

“Is Uber Income Considered Self-Employment in Canada?”

Yes. Uber drivers are self‑employed independent contractors under CRA rules, not employees.

That means:

- Uber does not deduct income tax

- Uber does not deduct CPP or EI

- You must report Uber income separately from your T4 job

- You are responsible for tracking income and expenses

Even if you drive only a few hours a week, CRA still considers this business income.

How Uber Income and T4 Income are Reported Together

If you have a regular job and drive for Uber, your tax return includes two income types:

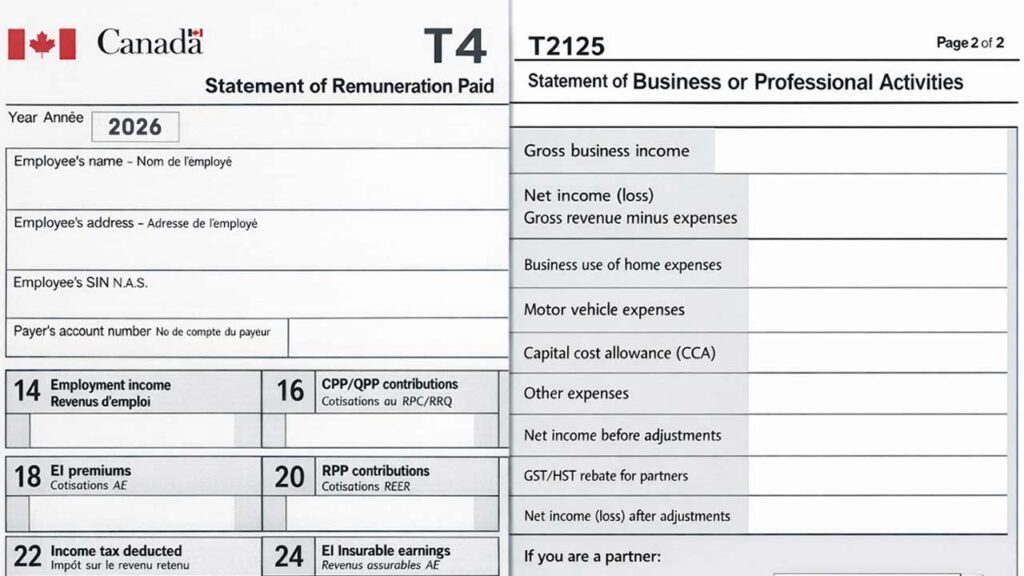

Employment income from your T4

This goes on your T1 tax return as usual. Taxes, CPP and EI are already deducted by your employer.

Business income from Uber driving

Uber income is reported on Form T2125 (Statement of Business or Professional Activities).

You report:

- Gross Uber earnings

- Less business expenses

- Net Uber income is added to your total taxable income

CRA looks at your combined income, not each job separately.

This is why many Uber drivers are surprised by a tax balance owing.

Why Uber Drivers With T4 Jobs Often Owe Tax

This is one of the most common complaints from our clients.

The reason is simple:

Your T4 job taxes are calculated assuming that’s your only income.

Uber income:

- Pushes you into a higher tax bracket

- Adds CPP contributions on net self-employment income

- May trigger GST HST obligations

Nothing is withheld upfront, so the tax bill shows up later.

Do Uber Drivers in Canada Need to Register for GST HST

This is where many drivers get caught.

Unlike most small businesses, rideshare drivers must register for GST HST from the first dollar in most provinces.

There is no small supplier exemption for Uber driving.

This means:

- You must register for a GST HST number

- You charge tax on each trip (Uber usually collects and remits on your behalf)

- You still must file GST HST returns

- You can claim input tax credits on eligible expenses

Common Uber Driver Tax Deductions in Canada

CRA allows Uber drivers to deduct reasonable business expenses related to earning income.

Common deductions include:

- Vehicle expenses based on business-use percentage

- Fuel, maintenance, oil changes

- Insurance related to rideshare

- Car washes

- Parking fees during trips

- Cell phone portion used for Uber app

- Uber service fees and commissions

- Accounting and tax preparation fees

You cannot deduct:

- Personal driving

- Full vehicle cost without prorating

- Meals unless very specific conditions apply

Mileage tracking is critical. CRA audits Uber drivers heavily on vehicle expenses.

CPP Impact for Uber Drivers With a T4 Job

Many drivers don’t realize this.

Uber income triggers additional CPP contributions because it’s self-employment income.

Even if CPP is already deducted on your T4:

- You still pay CPP on net Uber income

- This increases your tax payable

- It does increase future CPP benefits

There is no way to opt out.

Do Uber Drivers Need to Make Tax Instalments

If your balance owing exceeds CRA thresholds for two years in a row, you may be required to pay quarterly instalments.

This often happens when:

- Uber income grows

- T4 income stays the same

- No tax planning is done

Ignoring CRA instalment notices leads to interest and penalties.

Final Thoughts

Driving for Uber on the side with a T4 job is a solid way to earn extra income in Canada. But from the CRA point of view, you’ll be handed two tax systems within one return.

Understanding how employment income and self-employment income work together is the difference between control and surprise.

If you treat Uber driving like a real business, taxes become manageable instead of stressful.