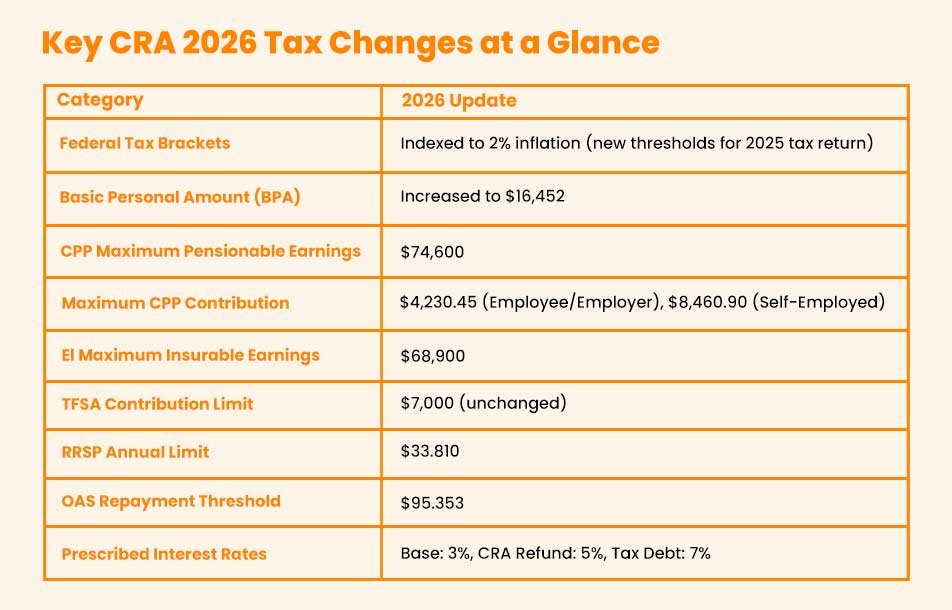

The Canada Revenue Agency just dropped its 2026 updates and they’re bringing some meaningful shifts to how Canadians will handle their taxes this year. We’re talking about adjusted tax brackets that reflect where inflation actually sits right now, contribution limits that create new planning opportunities and benefit thresholds that directly impact how much money stays in your pocket.

Every number the CRA releases translates into real decisions you’ll make throughout the year. Whether you’re earning a paycheck, running your own business or figuring out retirement contributions, these 2026 tax changes reshape your financial landscape in ways that matter.

1. Canada Federal Tax Brackets for 2026

The federal government dropped the lowest income tax bracket to 14% back in July 2025, which meant Canadians paid a blended rate of 14.5% when filing 2025 returns.

| Taxable Income | Federal Tax Rate |

|---|---|

| $0 – $58,523 | 14% |

| $58,523 – $117,045 | 20.5% |

| $117,045 – $181,440 | 26% |

| $181,440 – $258,482 | 29% |

| $258,482+ | 33% |

If your 2025 income landed near a bracket threshold, using RRSP contribution room before the March 2, 2026 deadline pulls your net income into a lower bracket and reduces your overall tax bill.

Note: Provincial tax brackets are also adjusted based on individual provincial inflation rates.

2. Basic Personal Amount (BPA)

The Basic Personal Amount (BPA) is the amount of income you can earn before paying any federal tax. In 2026, the BPA will increase to $16,452 from $16,129 in 2025.

| Item | 2026 Amount |

|---|---|

| Basic Personal Amount | $16,452 |

| Tax Credit Value (15% of BPA) | $2,468 |

| BPA Reduction Starts (High Income) | $180,000+ |

| BPA Fully Phased Out | $258,482+ |

Make sure your employer has an updated TD1 form on file so payroll systems don’t over-deduct tax based on outdated 2025 amounts.

3. Canada Pension Plan (CPP) Contributions

The Canada Revenue Agency has announced that the Year’s Maximum Pensionable Earnings (YMPE) under the Canada Pension Plan for 2026 will be $74,600, up 4.6% from $71,300 in 2025.

CPP Contribution Rates (CPP1)

Base CPP applies to all earnings up to the ceiling.

| CPP Item | 2026 Amount |

|---|---|

| Maximum Pensionable Earnings (YMPE) | $74,600 |

| Employee / Employer Contribution Rate | 5.95% |

| Maximum Employee / Employer Contribution | $4,230.45 |

| Self-Employed Contribution Rate | 11.9% |

| Maximum Self-Employed Contribution | $8,460.90 |

If you are an employer, plan for an extra $196.35 per high-earning employee in payroll costs just for the base CPP contribution. Self-employed or incorporated contractors should budget for CPP early and consider RRSP contributions to reduce taxable income.

The Second CPP Enhancement (CPP2)

CPP2 applies to high earners Canadians only, covering the gap between YMPE ($74,600) and YAMPE ($85,000).

| CPP2 Item | 2026 Amount |

|---|---|

| Additional Maximum Earnings (YAMPE) | $85,000 |

| CPP2 Contribution Rate | 4.0% |

| CPP2 Maximum (Employee / Employer) | $416.00 |

| CPP2 Maximum (Self-Employed) | $832.00 |

Unlike the “Base CPP” which provides a tax credit, CPP2 contributions are fully tax-deductible on your T1. High-income earners can use this strategically to reduce effective tax rates.

4. Employment Insurance (EI) Premiums

Employment Insurance premiums for 2026 show modest adjustments to maintain the EI Operating Account balance.

| Item | Regular Rate | Quebec Rate |

|---|---|---|

| Contribution Rate (Employee) | 1.63% | 1.31% |

| Maximum Contribution (Employee) | $1,123.07 | $860.67 |

| Maximum Insurable Earnings | $68,900 | $68,900 |

| Employer Contribution Rate | 1.4x Employee | 1.4x Employee |

Note: Employers contribute at 1.4 times the employee rate across all jurisdictions..

5. TFSA Contribution Limit

The Tax-Free Savings Account (TFSA) limit holds at $7,000 for 2026, matching the 2024 and 2025 contribution limits. If you have never contributed and were eligible since 2009, you now have $109,000 in total room.

| Year | Annual Limit | Cumulative Limit |

|---|---|---|

| 2023 | $6,500 | $88,000 |

| 2024 | $7,000 | $94,500 |

| 2025 | $7,000 | $103,000 |

| 2026 | $7,000 | $109,000 |

With the CRA paying 5% interest on tax refunds, filing your 2025 return early in February 2026 is the best way to move money into your TFSA for tax-free growth.

6. RRSP Contribution Limit

The Registered Retirement Savings Plan limit for 2026 is calculated as 18% of your 2025 earned income, capped at $33,810 federally. That’s up from $32,490 in 2025.

| Item | 2026 Amount |

|---|---|

| Maximum Annual Contribution | $33,810 |

| Percentage of 2025 Earned Income | 18% |

| RRSP Deadline (for 2025 tax year) | March 1, 2026 |

| Carry-Forward | Yes, unused room accumulates |

Unused contribution room from previous years carries forward automatically, so you never lose it.

7. Old Age Security (OAS)

For 2026, the CRA has adjusted the income ceiling, giving Canadian seniors more room to earn before their benefits are reduced.

| Item | 2026 Threshold |

|---|---|

| OAS Repayment Threshold | $95,353 |

| Clawback Begins | Above $95,353 |

| Full Clawback | Higher net income beyond threshold |

Seniors approaching this threshold should consider using TFSA withdrawals for extra income needs instead of RRSP or RRIF withdrawals that increase taxable income.

8. Prescribed Interest Rates

The CRA has confirmed that the interest rate on overdue tax debt remains at 7% for Q1 2026 (subject to final announcement). Conversely, the “Prescribed Rate” used for family income-splitting loans is 3%.

| Type | Rate (2026) |

|---|---|

| Base Prescribed Rate | 3% |

| CRA Refund Rate | 5% |

| CRA Tax Debt Rate | 7% |

If you owe the CRA, prioritize that debt over a mortgage or car loan; 7% interest from the CRA is non-deductible and compounds daily.

What You Should Do Right Now

Don’t wait until April to think about these changes. Here is your 2026 immediate action checklist:

- Review your withholding to ensure your employer is applying the 2026 rates properly. Make sure you’re on track for required quarterly instalments if you’re self-employed.

- Max out your RRSP by March 2 if you’re close to a threshold where the deduction really matters, based on your 2025 income. Think about TFSAs early in the year, too, so you have the most time for them to grow tax-free.

- If you’re close to retirement, think about the interplay between OAS clawback and CPP decisions. The difference between good and bad planning could be more than $100,000 in retirement.

Reach out to tax professionals who have expertise in your area of concern, whether it’s self-employment, corporate structures, or retirement planning. There are many opportunities in this new environment, but only if you know how to take advantage of them.