Starting a corporation in Canada whether you go federal or provincial, feels exciting. There’s a lot to think about, but taxes? Honestly, you can’t ignore them, even in the early days.

A lot of new business owners wonder: “Do I really have to file a T2 tax return if my corporation hasn’t made a single dollar yet?”

The answer’s simple: yes. The Canada Revenue Agency wants that T2 Corporation Income Tax Return from you every year, no matter what, even if you have no income and no expenses. Miss the deadline, and you’re looking at penalties, late fees, and some unwanted attention from the CRA.

So, let’s break down what you need to know about your first T2 filing. We’ll walk you through why it matters and what you need to do to stay on the CRA’s good side right from the start.

Your Corporation Is a Separate Legal Entity in Canada

When you form a corporation, your business itself is a legal entity that is separate from you as its owner. This separation protects your personal assets, but it also means the CRA considers your corporation active from the day it is incorporated.

All newly incorporated businesses in Canada must prepare and file a T2 Corporation Income Tax Return for the year in which the corporation was first incorporated. Regardless of whether or not the corporation earned income, sold any goods/services, incurred expenses, etc., a T2 tax return must be filed.

How to Determine Your First T2 Tax Return Deadline

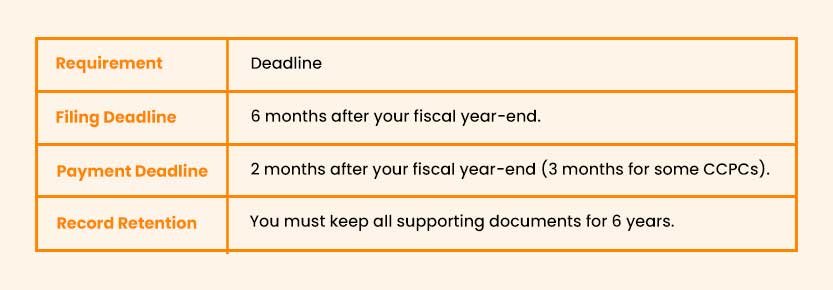

Personal tax returns follow the April 30 deadline every year, but your T2 corporate return works differently. It follows your corporation’s fiscal year-end, not the calendar. In your first year, you can choose a fiscal year-end that’s up to 53 weeks from your incorporation date. This date sets the foundation for T2 filing deadlines.

This means you are in control of your first T2 tax return deadline. You can choose a year-end that provides you with enough time to get your business off the ground and get your bookkeeping in order.

This means you are in control of your first T2 tax return deadline. You can choose a year-end that provides you with enough time to get your business off the ground and get your bookkeeping in order.

For example: If your business was incorporated on August 15, 2025, you could choose a fiscal year-end of August 14, 2026. Your first T2 return would then be due by February 14, 2027.

CRA Penalties for Not Filing a T2 Tax Return

Many startup corporations fall into the trap of “waiting until there’s revenue” to think about taxes. This leaves them having already passed their first filing deadline, thereby incurring penalties unnecessarily.

The CRA treats missed T2 corporate tax returns as serious non-compliance. If you fail to file on time, you may be charged:

- A late-filing penalty of $25 per day, up to a maximum of $2,500. This applies even if your corporation had zero income and no tax payable.

- If your corporation has tax owed, the penalty is 5% of the unpaid tax, plus an additional 1% for each full month your return is late.

Apart from the financial penalties, skipping your T2 filing can negatively impact your corporate tax history. This may affect your ability to secure loans in the future or even make it more difficult to close your corporation down at some point in time.

A Note on the T2 Short Return

If your corporation is a Canadian-controlled private corporation (CCPC) and had a loss or no income for its first year, it may be eligible to file the simplified T2 Short Return. This is a two-page form that makes the filing process much easier and is specifically designed for inactive or low-activity corporations.

However, even if you qualify for the short return, you still must file it on time.

Do You Need to File a T2 Return With Zero Income?

This is the biggest pitfall for new entrepreneurs. They delay filing, believing tax requirements only apply when the business is profitable. Unfortunately, this causes unnecessary penalties from the CRA and added stress. Filing on time, even a nil return, keeps your corporation compliant and your options open.

How to File Your First T2 Tax Return Correctly

- Get your financial statements ready for the year, either handle them yourself or let a tax accountant take over.

- Complete the T2 return, make sure you include every required schedule.

- You must file the T2 return within six months of your fiscal year-end to avoid penalties.

- Keep proper records in case the CRA asks for documentation to support the information reported on your return.

The Bottom Line

The first tax return that you file as a T2 is much more than a mere formality. It is the beginning of a compliant and financially solid corporate history. By being aware of your fiscal year-end and making the necessary returns on time, you establish the right precedent and provides protection for the long term through avoidance of costly CRA penalties.

Take time to make sure this step is done correctly, and an experienced corporate tax accountant could provide you with information about the deadlines or the needed forms.