Think of December 31st as a deadline with a dollar sign attached to it. Every year, thousands of Canadians miss out on significant savings simply because they didn’t know that “waiting until next year” actually meant losing an entire year of growth. Whether you’re saving for your first home, supporting your kids’ education, or just trying to keep more of your side-hustle profit, the next few weeks are your most valuable window of the year.

Effective tax planning isn’t just about filing on time; it’s about making sure the money the government has already set aside for you actually ends up in your pocket.

Let’s walk through how a few simple, CRA-approved tweaks today can pay off in a big way tomorrow.

1. Maximize Your TFSA Contribution Room

The Tax-Free Savings Account (TFSA) withdrawal timing strategy is one of the most powerful yet underutilized year-end planning moves available to Canadians.

How TFSA Withdrawal Timing Actually Works

Here’s what trips people up. When you withdraw money from your TFSA, that withdrawn amount gets added back to your contribution room, but not until January 1 of the following year.

If you withdraw before December 31, you get that room back on January 1 of the next year. If you wait and withdraw in January instead, you don’t get the room back until January 1 of the year after that.

| Scenario | Action | Contribution Room |

|---|---|---|

| Withdraw December 2025 | $10,000 | Added Jan 1, 2026 |

| Withdraw February 2026 | $10,000 | Added Jan 1, 2027 |

The timing difference matters tremendously. If you take money out in December, you’ll have it for February, and should you have some extra cash anytime in 2026, you’ll be able to recontribute it immediately back to the TFSA.

The Growth Amplification Strategy

If you invested $4,000 years ago and it grew to $10,000, withdrawing that $10,000 in December resets your room to include all that growth. On January 1, your available room increases by the full $10,000 plus the new $7,000 annual limit.

Spouse Income Splitting Through TFSA

If one spouse earns more than the other, the higher-earning spouse can give money to their partner, and the partner can use it to make contributions to their own TFSA.

Unlike RRSPs where spousal contributions have attribution rules, TFSA contributions are completely free from attribution concerns. The higher-earning spouse can gift money to the lower-earning spouse specifically for TFSA contributions and all future growth belongs entirely to the lower-earning spouse.

2025 TFSA Contribution Limits and Cumulative Room

For 2025, the TFSA contribution limit is $7,000. The total TFSA contribution room available for Canadians 18 years of age or over since the plan’s inception in 2009 is $102,000, including the $7,000 annual limit for 2025.

If you’ve never contributed to a TFSA and you were 18 or older in 2009, you have $102,000 of cumulative contribution room available right now. That’s a massive tax-shelter opportunity sitting unused.

2. Open an FHSA Before December 31st

The First Home Savings Account (FHSA) represents one of the most powerful tax-advantaged savings vehicles the government has ever created, combining the best features of both RRSPs (tax-deductible contributions) and TFSAs (tax-free withdrawals for qualifying purposes).

| Scenario | Room Year 1 | Room Year 2 | Years to Max $40,000 |

|---|---|---|---|

| Open Dec 2025 | $8,000 | $16,000 | 3 |

| Open Jan 2026 | $8,000 | $16,000 | 4 |

FHSA Eligibility Requirements

To open an FHSA, you must be a resident of Canada, at least 18 years old, and a first-time home buyer. For the purposes of opening an FHSA, you are considered a first-time home buyer if you have not inhabited a qualifying home owned by either you or your partner in the current or any of the four prior calendar years.

This “first-time buyer” definition is more flexible than many people realize. If you previously owned a home but haven’t lived in a home you owned for the past four years, you qualify. If you sold your home and rented for four years, you’re eligible again.

FHSA Contribution Structure and Limits

Once opened, an FHSA allows you to contribute up to $8,000 annually, subject to any available carryforward room, and up to a $40,000 lifetime contribution limit.

For the years following the year in which the FHSA is opened, an FHSA holder’s contribution room for the year is $8,000 plus unused contribution room, or carryforward, from the prior year, to a maximum of $8,000.

FHSA Contribution Deadline Unlike RRSP

Unlike an RRSP, any contributions you make to an FHSA in the first 60 days of the year can’t be deducted from the previous year’s income. The deadline to contribute to your FHSA is December 31 of each year.

RRSP contributions made in the first 60 days of the new year can be claimed on the previous year’s tax return. FHSA contributions cannot. The December 31 deadline is firm for claiming 2025 tax deductions.

FHSA vs RRSP Home Buyers’ Plan

Both allow you to use registered funds for home purchases, but they work very differently:

| Feature | FHSA | RRSP HBP |

|---|---|---|

| Contributions | Tax-deductible | Tax-deductible |

| Withdrawals | Tax-free for first home | Tax-deferred, must repay |

| Annual Limit | $8,000 | N/A |

| Lifetime Limit | $40,000 | $60,000 |

| Repayment Required | No | Yes |

The optimal strategy for many first-time buyers is using both: maximize FHSA first for the superior tax treatment, then supplement with RRSP HBP if you need additional funds.

3. Strategic RRSP Contribution Timing

The Registered Retirement Savings Plan (RRSP) remains one of Canada’s most powerful tax deferral vehicles, but the timing of your contributions matters far more than most people realize.

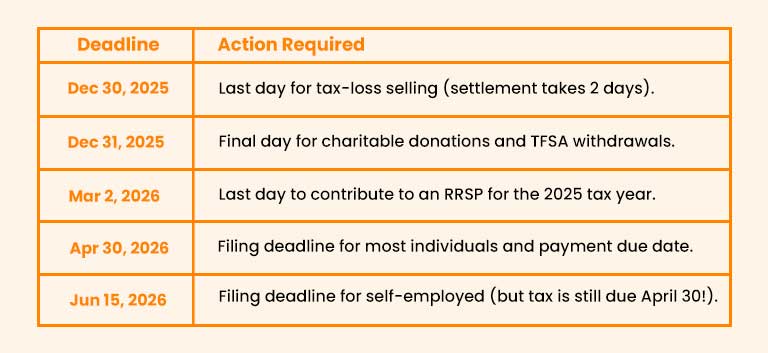

The March 2026 RRSP Deadline

To be deductible on your 2025 personal income tax return, RRSP contributions must be made by March 2, 2026, as March 1 is a Sunday.

Unlike most tax planning strategies that require action by December 31, RRSP contributions have a grace period extending 60 days into the new year. This flexibility creates strategic timing opportunities.

2025 RRSP Contribution Limits

The maximum RRSP contribution limit in 2025, if you do not have any carryforward room, is $32,490 before any adjustments for certain pension amounts.

Your actual RRSP limit is the lesser of:

- $32,490 (the 2025 maximum), or

- 18% of your previous year’s earned income

For 2026, the RRSP annual dollar limit increases to $33,810.

| Income Situation | Strategy | Tax Impact |

|---|---|---|

| High 2025 income / bonus / capital gains | Contribute now | Immediate tax relief |

| Rising income in future | Contribute later | Deduct in higher bracket, save more |

| Turning 71 in 2025 | Max final contribution + $2,000 cushion | Large deduction, minimal penalty |

Pension Adjustment Impact on RRSP Room

Your RRSP deduction limit is 18% of your gross salary, but if you have a pension (either defined benefit or defined contribution), that limit may be lower due to the inclusion of your pension contributions.

Your T4 slip shows your Pension Adjustment in Box 52. This PA reduces your RRSP contribution room for the following year.

If you participate in a defined contribution pension and both you and your employer contribute 5% of your $100,000 salary ($10,000 total), your PA will be approximately $10,000, reducing your RRSP room from the theoretical $18,000 (18% of $100,000) to $8,000.

Always check your most recent Notice of Assessment for your exact RRSP deduction limit, which already factors in your pension adjustments.

Spousal RRSP for Income Splitting

Contributing to your partner’s spousal RRSP facilitates income splitting. The higher-income partner contributes to the spousal RRSP of the lower-income partner.

Spousal RRSPs allow the higher-earning spouse to claim the tax deduction today while building retirement income that will be taxed in the lower-earning spouse’s hands in retirement.

Critical attribution rule: If your spouse or partner makes a withdrawal from a spousal or partner RRSP or RRIF and you made a contribution to an RRSP for your spouse or partner in any of the previous three years, attribution will occur.

To avoid attribution, you must wait at least three full calendar years after your last spousal RRSP contribution before your spouse can withdraw without the income attributing back to you.

4. Tax-Loss Harvesting to Offset Capital Gains

If you’ve realized capital gains this year (stocks, crypto, or real estate), selling “losers” in your non-registered accounts can erase that tax bill.

Understanding Capital Gains and Losses

The capital gains inclusion rate has remained at 50% for both 2024 and 2025, with no increase expected for 2026.

This means when you sell an investment for a profit, 50% of that gain is added to your taxable income. Conversely, when you sell at a loss, 50% of that loss can offset capital gains.

Summary of Harvesting Rules & Deadlines

| Feature | Rule / Deadline |

| Last Trade Date | December 30, 2025 (Assumes T+1 settlement) |

| Inclusion Rate | 50% for individuals (up to $250k gain) |

| Superficial Loss Window | 30 days before + 30 days after the sale (61 days total) |

| Identical Property | You cannot buy the exact same asset (e.g., sell TD, buy TD) |

| Loss Carry-Back | Can offset gains from 2022, 2023, or 2024 |

The Critical Settlement Date Rule

Keep in mind that a trade must be settled in the 2025 calendar year to be considered a 2025 disposition. Assuming a one-day settlement, a transaction must be initiated by December 30.

Canadian stocks typically settle T+2 (two business days after trade date). This means:

The Superficial Loss Rule

Be aware of the superficial loss rules, which deny a loss if you or an affiliated person repurchases the disposed investment within 30 days before or after the date of the original sale.

The superficial loss rule prevents you from claiming a loss if you (or your spouse, or your RRSP, or your TFSA) reacquire the same investment within the 30-day window.

Deferring Capital Gains to 2026

Deferring the realization of capital gains to 2026 is another way to potentially minimize taxes. If a gain is realized in 2025, then tax on that gain would be due by April 30, 2026. If you wait until January to sell, then you won’t have to pay tax on that gain until April 30, 2027.

If you’re planning to sell winning investments, consider waiting until early January 2026. You defer the tax payment by an entire year, improving your cash flow and giving you more time to plan.

5. Charitable Donations Before December 31st

Making charitable donations before year-end provides significant tax benefits while supporting causes you care about.

The Donation Tax Credit Structure

The donation credit is 15% of the donation for the first $200 in donations each year, and 29% thereafter (up to 33% for those in the top tax bracket). Provincial credit rates vary but generally increase at that threshold as well.

Donating Securities vs Cash

| Type | Donation Amount | Tax Credit | Capital Gains Tax | Net Cost |

|---|---|---|---|---|

| Cash | $10,000 | $4,500 | N/A | $5,500 |

| Securities | $10,000 (cost $4,000) | $4,500 | $1,200 avoided | $4,300 |

Start this process in early December to ensure completion before December 31.

Other Year-End Tax Moves for Canadians

- Medical Expenses: CRA allows you to claim medical expenses for any 12-month period ending in 2025. If you’ve had a year with significant dental work, prescriptions, or travel for specialists, check if you’ve crossed the threshold (3% of your net income or $2,834).

- RESP Contributions: Parents can receive the full $500 annual government grant by contributing $2,500 per child to a Registered Education Savings Plan (RESP) by December 31. If you missed contributions in previous years, you can catch up by contributing $5,000 to trigger a $1,000 grant.

- Side Hustle / Freelance: Consider prepaying for 2026 software subscriptions, professional memberships, or office supplies now to deduct them against your 2025 income. And if you need a new laptop or vehicle for work, purchasing and putting it into use before December 31 allows you to claim a half-year of depreciation (CCA) this year.

- Disability Tax Credit: The Disability Tax Credit is one of Canada’s most valuable credits, but many T2201 certificates are time-limited rather than permanent. Log in to your CRA My Account to see if your certificate expires in 2025. If it does, you need to have a medical practitioner certify a new form immediately.

Final Thought

Tax planning isn’t a one-time event—it’s a timing game. While most people are focused on the New Year celebrations, proactive taxpayers are already looking at their refreshed TFSA and FHSA contribution limits and planning their next move. You now have the strategies; the real value comes from executing them at the right time.

One important reminder: if you expect your income to increase significantly next year due to a promotion or business growth, it can make sense to contribute to your RRSP early but defer claiming the deduction until your 2026 return, when it can offset a higher tax bracket.

Because every financial situation is different, consider speaking with a qualified tax accountant to ensure these strategies are properly tailored to your goals and don’t create unintended consequences.