If you pay or receive child support in Canada, mark your calendar: major changes to the Federal Child Support Tables are coming on October 1, 2025.

After eight years, the Department of Justice is updating the tables to reflect current tax rules and the real cost of living. It has been nearly a decade since the last update.

Whether you pay support, receive it or advise others, this update matters. These changes are not just administrative, they could have a real impact on your overall family’s finances. Here’s what you need to know about the upcoming update.

What Are the Federal Child Support Tables in Canada?

The Federal Child Support Tables are the foundation of Canada’s child support system. They set out the amounts of child support that should be paid based on income, number of children and province or territory.

The amount is calculated based on three simple things:

- The paying parent’s annual income (gross, before taxes).

- The number of children needing support.

- The province or territory where the receiving parent lives.

These tables set out the basic monthly support amounts under the Federal Child Support Guidelines. They were last updated in 2017, before recent increases in the cost of living.

Why This 2025 Child Support Update Isn’t Just ‘Routine’

Child support calculations are about more than fairness. They are designed to ensure children’s needs are met in today’s economic environment.

The tables use complex federal, provincial and territorial tax rates. They also factor in the fact that support payments are not taxable for the recipient and not deductible for the payer. Since every major tax bracket and cost has changed since 2017, the original calculations are no longer accurate.

Reasons Behind the 2025 Federal Child Support Table Changes

The new Federal Child Support Tables are being updated to match the new tax rules effective October 1, 2025. Here’s what’s behind this big change:

- Tax Bracket Changes: Federal and provincial tax brackets have changed several times since 2017. These changes affect the amount of disposable income parents have after taxes.

- Cost of Living Changes: Inflation has dramatically increased the real cost of raising kids, from rent to groceries to extracurricular activities. The old numbers just don’t cut it.

- Tax Policy Changes: Changes to federal and provincial tax credits, deductions and benefit programs like the Canada Child Benefit have also impacted how support is calculated.

Will Your Child Support Payment Change After October 1st?

While we won’t know the exact new numbers until they’re officially published, family law experts are making strong predictions based on the current economy:

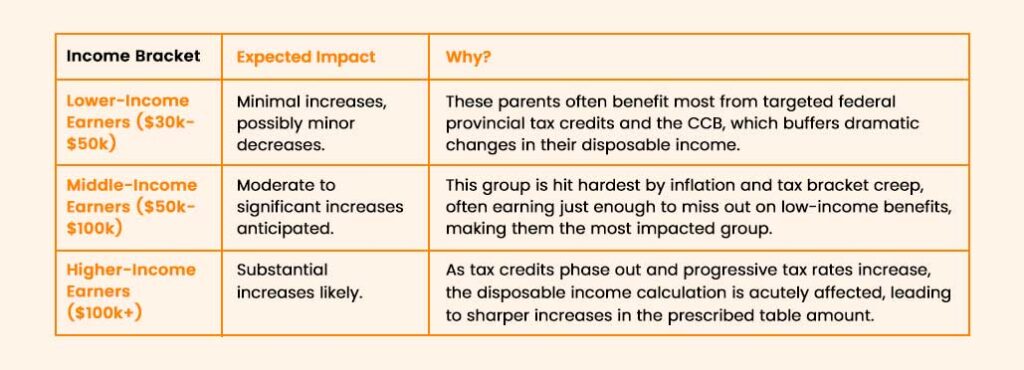

- Most Parents: Support amounts are expected to increase for most income levels.

- High-Income Earners: Larger increases are likely as tax benefits phase out and higher tax rates apply.

- The Exceptions: Some lower-income ranges may experience slight decreases, as recent tax benefits have increased disposable income.

Do Existing Child Support Orders Update Automatically in 2025?

No, your existing child support order does not automatically adjust to the new tables. This is important to understand.

The new tables are considered a change in circumstances. If the new amount is different from your current order, you have a legal basis to ask the court to vary your existing order.

How to Get Your Order Changed

1. Mutual Agreement (The Fastest Way)

If both parents agree to the new amount, you can sign a consent agreement and file it with the court.

2. Court Application for Variation (The Formal Way)

If you cannot agree, the parent seeking the change must file a formal variation application with the court. This requires providing updated income information and may involve attending hearings.

How to Calculate Your New 2025 Child Support Payment

The Department of Justice will release updated tools soon. Until then, here is how the current calculation process works and what you need to prepare:

- Determine Annual Income: Figure out the paying parent’s total annual income before taxes.

- Identify Relevant Province: The table for the province or territory where the recipient parent lives is the one you must use.

- Find Your Table Amount: Look up the basic monthly amount (currently set for incomes up to $150,000).

- Consider Special Expenses: Remember to include the proportional sharing of extraordinary expenses, such as high daycare costs, specific medical needs or important extracurricular activities.

Why Your Province or Territory Affects Your Child Support Amount

Child support amounts vary by province or territory due to local tax structures, provincial benefits and the cost of living.

- Generally Higher Support: Provinces with higher tax rates, such as Quebec or Nova Scotia, often result in higher calculated support obligations because the paying parent has less disposable income.

- Generally Lower Support: Provinces with lower income tax rates, such as Alberta, tend to have lower calculated support obligations.

2025 Child Support Table Impact by Income Level in Canada

The impact won’t be uniform. Here’s what parents in different income brackets can realistically expect:

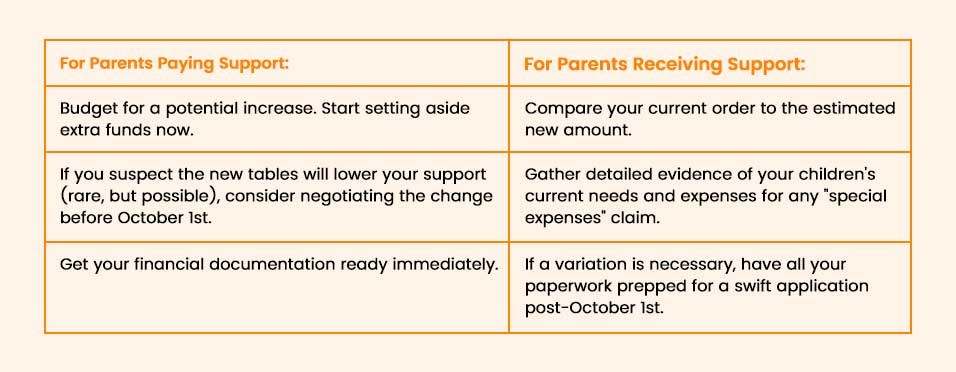

Should You Negotiate Before or After October 1?

This depends on whether you are paying or receiving support:

Should You Handle It Yourself or Hire a Lawyer?

While a straightforward recalculation can often be handled on your own, some situations require professional assistance.

When to Get Legal Help:

- If you are self-employed, a business owner or have variable income (commissions, international assets).

- Any disagreement about income, shared custody or special needs children requiring extraordinary expenses.

- If there are existing spousal support obligations or a history of non-compliance or arrears.

When You Can Handle It Yourself:

- Straightforward, salaried employment income.

- Mutual written agreement on the new support amount.

- No disputes over custody or special expenses.

Common Mistakes to to Avoid During 2025 Child Support Update

- Using the Wrong Tables: Do not use the new 2025 tables for any period before October 1, 2025. Always use the 2017 tables for periods prior to 2017.

- Assuming Automatic Change: Do not assume your current court order will automatically update. You must take legal action or sign an agreement.

- Incomplete Income Information: Failing to include bonuses, commissions, or all sources of income in your documentation can lead to errors and legal issues.

- Changing Payments Without Authority: Do not change the support amount you pay or receive without a signed agreement or a formal court order.

Final Thoughts

The 2025 Federal Child Support Tables update is the biggest change in almost 8 years. Every family will be affected differently but preparation is key.

Child support is not only a legal obligation, but it is also an opportunity to ensure that your kids can thrive in today’s economy financially, whether that means paying, or receiving, more. Don’t wait any longer to start getting ready for a change. You may decide to contact a professional based on the complexities of your case. In any event, keep the best interest of the children first.

Disclaimer: The information provided is general guidance on the 2025 Federal Child Support Tables update. Child support situations are highly individual and complex. Always consult with a qualified family lawyer or professional accountant for advice specific to your circumstances and jurisdiction.